A Full Suite of

STRATEGIC. FINANCIAL. OPERATIONAL. PHYSICAL.

The Plasencia Group offers strategic asset management and property oversight services to hotel and resort owners and investors who seek active and focused supervision to preserve and enhance their assets’ values. The firm’s clients include major life insurance companies, pension funds, and high-net-worth individuals and family offices. These clients have realized the value of the unvarnished advice of a seasoned asset manager who watches over operations, and provides an analysis of the investment, all the while keeping a finger on the pulse of both capital markets and the long-term value of the investment.

Our role is to help hotel owners increase the value of a particular asset or their wider portfolio in line with their business objectives. Our expert team of senior hotel asset managers is partnered with the owners of leading international luxury hotels and resorts. We’re uniquely experienced on ‘all sides of the table’ – operations, ownership and asset management – and our global reputation is built on a cutting-edge understanding of the tourism industry, as well as industry-leading expertise relating to the latest hotel asset management techniques.

Asset Management from All Perspectives

UNIQULEY EXPERIENCED ON ALL SIDES OF THE TABLE.

Owner Representation

- Develop strategic vision for hotel property or portfolio

- Brand / Operator Overview

- Capital Expenditure review, planning and benchmarking

- Assistance in negotiating management contracts

- Align property management with ownership

- Investment goals

Sales, Marketing & Revenue Management

- Review sales processes and structure

- Evaluate and maximize resource efficiency

- Review hotel positioning

- Benchmark against the competitive set

- Review pricing strategy for rooms, food & beverage and conference venues

Operational Efficiency Optimization

- Establish a Performance Management System for hotel leadership

- Review property maintenance for quality control

- Establish training processes for hotel management

- Review all SOPs, F&B concepts

- Operations audit with key focus on guest touch-point areas

Financial Performance Review

- Review number and sizes of suppliers

- Review uniqueness of service

- Review ability to substitute

- Review cost of supplier replacement

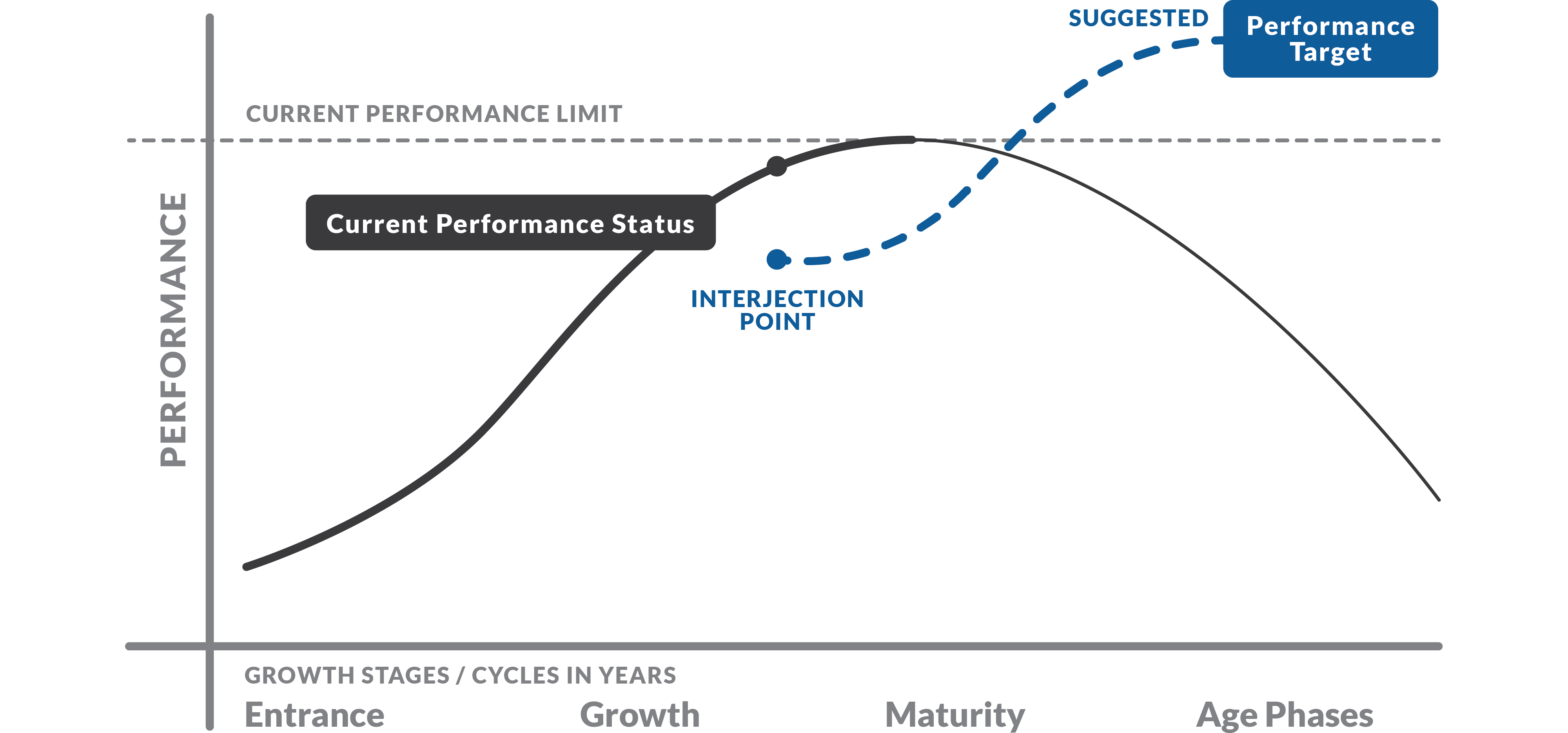

Our Targeted Approach

FULLY-DEDICATED TO OUR CLIENTS’ BEST-INTERESTS.

We take a targeted approach to working with all our clients. That means we’re fully dedicated to providing a high-level, independent and personal service while representing our clients’ best interests at all times. When we decide to take on a client or a specific project, we always give preference to those opportunities which may lead to long-term personal relationships. This allows us to build a detailed understanding of the minutiae of our clients’ assets and their business objectives, while bringing our uniquely tailor-made advice to the table.

We select our clients and the projects on which we work to create lifelong relationships, and we are fully committed to your business to obtain the best results possible.

We analyze your needs, design the necessary action plan, advise and operating executive team on how to implement it successfully. We provide support in marketing and sales, strategic positioning, revenue management, social media and guest reviews in order to draw up the appropriate plan to meet your sales targets as soon as possible. Through our advice and management of your assets, we ensure investors will obtain a much higher return, above-average revenues and greater flow through. Either by managing your hotels, repositioning your hotels as independent brands, the proposal of forming part of the appropriate hotel chain or incorporating it under the umbrella of a leading brand from the hotel sector. Hotels are medium to long-term investments where relationships between the owner, the operator and the team on the ground are extremely important. We believe that our main role is to create an environment in which the three parties can thrive and develop, as only then can we achieve a maximum valuation of the asset.

Case Studies

Hilton Dallas Southlake

Town Square

Dallas, Texas

In the face of the COVID-19 pandemic, The Plasencia Group represented a private owner and achieved

the highest per-key price in Texas in 2020.

Renaissance Vinoy Resort

& Golf Club

St. Petersburg, Florida

A brief intro about the Case Study…

Representative Engagements

Our Asset Management Team

Our experience can make your lodging investment strategy more successful. Get in touch with one of our Florida lodging investment professionals to discuss your holdings anywhere in North America.

Find out more about our Asset Management services and how we can help with your property.