September 16, 2024

Download a PDF version of Market Insights – Ten Years in Tampa

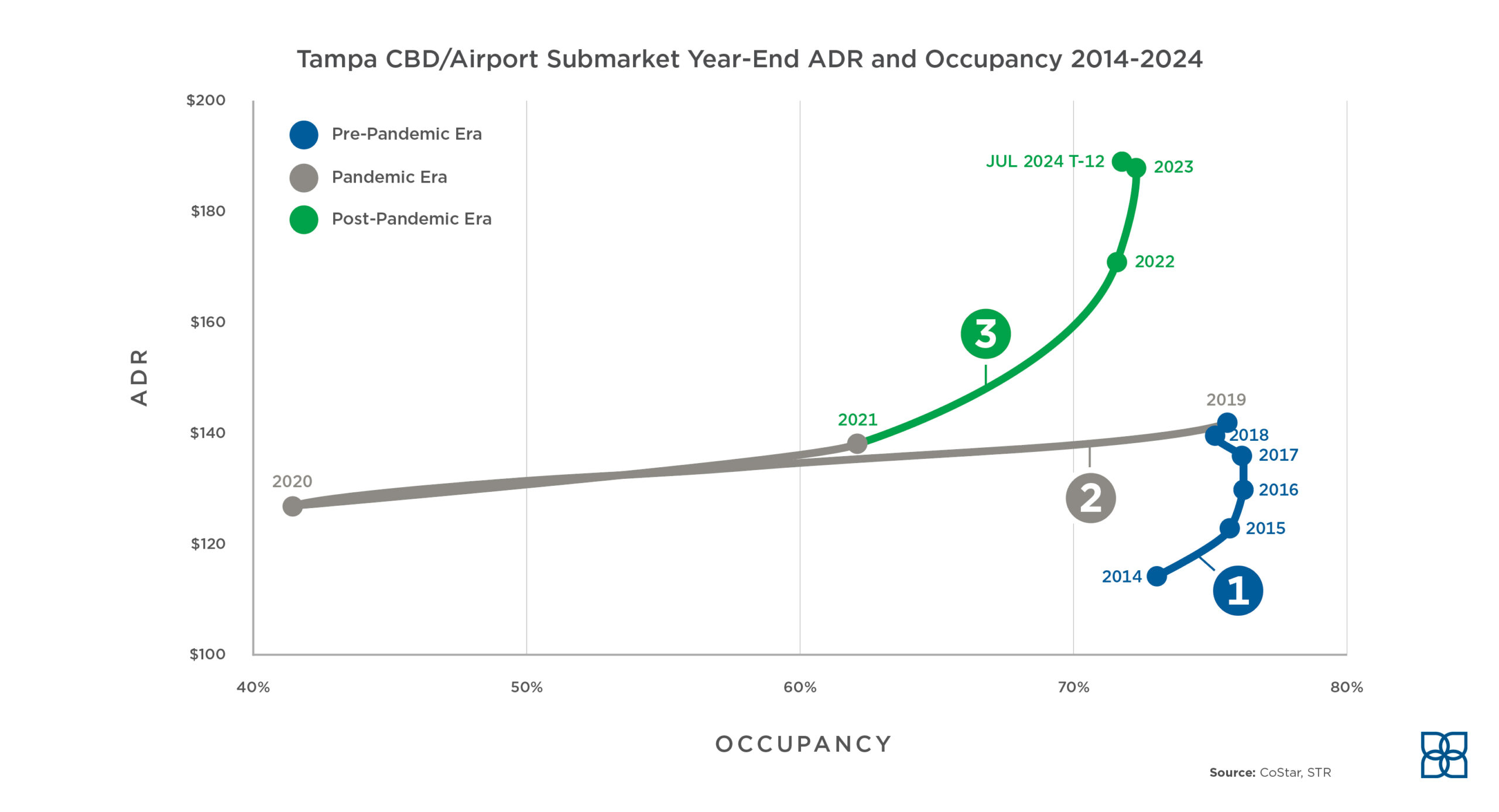

Over the past ten years, Tampa’s lodging industry has experienced a generational transformation. Our firm has had a front row seat to our hometown’s emergence as a true institutional caliber investment destination, and we wanted to share a brief retrospective on what has driven this rise. The chart below tells a compelling story, which we break into three phases: 1. The Pre-Pandemic Era, from 2014 to 2019, 2. The Pandemic Era, from 2020 to 2021, and 3. The Post-Pandemic Era, from 2022 to today. The data shown is derived from STR’s Tampa CBD/Airport submarket, which encompasses Tampa’s Downtown and Westshore submarkets.

The Pre-Pandemic Era (2014-2019)

Tampa ended the year 2014 with a market-wide RevPAR of $83, with an Occupancy of 72.9% and an ADR of $114. In all, the submarket comprised 46,513 hotel keys, following a flurry of new product recently delivered to the market, including the Epicurean Hotel, Autograph Collection (2013), Le Méridien Tampa (2014), and the Aloft Tampa Downtown (2014). These hotels represented some of the first boutique, lifestyle assets in the market and were instrumental in setting the stage for the infusion of similar high-quality product into the market that followed. This infusion in turn ushered in the ADR growth we have seen over the following decade. In October 2014, our firm facilitated the sale of the Marriott Waterside (now known as the Marriott Water Street) to Jeff Vinik, local investor and owner of the Tampa Bay Lightning, which ultimately became the first piece of what is now the transformational Water Street development.

From 2014 through 2019, the market achieved meteoric RevPAR growth, driven by nearly 25% ADR growth and almost three full points of Occupancy growth. At the end of 2019, the submarket’s room count had grown to 50,656 keys, including major expansions into Westshore – the AC Tampa Airport opened in 2018, and The CURRENT Hotel, Autograph Collection opened in 2019 – and Downtown Tampa’s Channel District, where the dual-core Hampton Inn/Home2 came online in 2019.

The 2016 expansion of the Tampa Riverwalk – connecting Downtown Tampa with the burgeoning Tampa Heights neighborhood – and the 2018 opening of Armature Works in Tampa Heights were major catalysts to growth during this period, as they brought residents and accompanying amenities to an area historically relegated to office work only. Additionally, Tampa hosted the college football championship in early 2017, a harbinger of Tampa’s prominence on the national sports scene. Similarly, the Tampa Bay Lightning, which play home games at Amalie Arena in Downtown Tampa, made consistent playoff runs in every year but 2017. All of these activities provided direct leisure demand in the market, while also fostering an environment that made other segments more inclined to do business in town.

The Pandemic Era (2020-2021)

Tampa’s lodging industry was undoubtedly impacted by COVID-19, but after a major performance decline in 2020, Tampa rebounded better than most markets globally, including a near return to pre-pandemic ADR ($142) by year-end 2021 ($138). The performance data chart shown on page 2 also includes the absorption of nearly 1,350 keys, including the 519-room JW Marriott Tampa Water Street (2020), and the 226-room dual core Aloft/Element Tampa Midtown (2021), an unprecedented amount of new supply for the submarket.

Water Street itself started taking shape, with the relocation of the University of South Florida medical school from North Tampa to Water Street, the opening of the flagship Heron Water Street Apartments, and the unveiling of a $50-million renovation of the Marriott Water Street.

The blow of COVID-19 was lightened, at least in Tampa, by the advent of “Champa Bay,” sparked by Tom Brady’s tenure in Tampa. It’s hard to overstate the market-wide buzz of those heady days, punctuated by the Tampa Bay Lightning winning back-to-back Stanley Cups in 2020 and 2021, and the Bucs winning the Super Bowl in front of home fans at Raymond James Stadium (followed by the now ubiquitous image of Tom Brady tossing the Lombardi Trophy between boats during the celebratory boat parade). This national focus on Tampa, paired with residual lockdowns in many places across the country, provided incredible optics and a boost to the local lodging industry.

The Post-Pandemic Era (2022-2024)

Following the pandemic, starting in 2022, Tampa’s hotel performance has been nothing short of stellar. The market has nearly returned to pre-pandemic Occupancy but with an ADR over 30% higher than year-end 2019. The opening of the Tampa Edition in 2022 represented the delivery of the first true luxury hotel into the market, enhancing Tampa’s ability to draw higher-rated business and allowing hotels market-wide to push ADR with a new lead horse in town. The new Edition, paired with the recently opened JW Marriott and renovated Marriott Water Street, provides the city with a self-contained complex of over 150,000 square feet of meeting space. This complex has induced significant group demand at the same time the nearby Tampa Convention Center is housing citywide events, creating an entirely new demand compression dynamic in the city, and allowing Tampa hotels to aggressively push rate. Visit Tampa Bay, the market’s destination marketing organization, did yeoman’s work in bringing new meetings and events to the market, and as a result, Tampa has become a compelling group destination at a time where that segment is critical. Airlift into the market continues to improve via Tampa International Airport, which continues to garner major accolades, including being ranked by J.D. Power as the top North American Airport in 2022 and 2023.

Where Tampa is Headed

Notwithstanding Tampa’s ascendancy over the past decade, we think the best is yet to come. Demographic trends remain in the market’s favor – Tampa remains a hotbed for in-migration, and its workforce continues to get stronger. The region’s infrastructure is vastly improving as well, with award-winning Tampa International Airport in the midst of a 16-gate addition, a Brightline rail spur linking Tampa to Orlando and South Florida contemplated, and an expansion of the Tampa Riverwalk impending.

On the hotel front, Tampa remains a relatively low-supply environment, with very little in the pipeline today. Local hoteliers held the line on ADR during the pandemic to great effect, and now that Occupancy is in striking distance of pre-pandemic benchmarks, properties can continue to focus on improving ADR. We’ve seen pronounced progress in values over the last ten years as well, as the quality of what has traded has improved drastically, as has underlying property-level performance.

Tampa is near and dear to our hearts at The Plasencia Group, and we are proud of the progress our community has made over the last decade. It continues to be an excellent venue for investment, and we’d welcome the opportunity to share more detail regarding what makes Tampa tick. If you’re contemplating a disposition or looking to acquire a property in the region, leverage The Plasencia Group team’s thirty-one years of local market expertise and industry-leading know-how. Reach out to one of our Investment Sales team members today to start a discussion on how we can help you achieve your hospitality investment objectives.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.