September 23, 2024, by Dexter Wood, Senior Managing Director

Download a PDF version of Hospitality Industry Insights – Fed Easing Will Drive Optimism for Hotel Transaction Activity

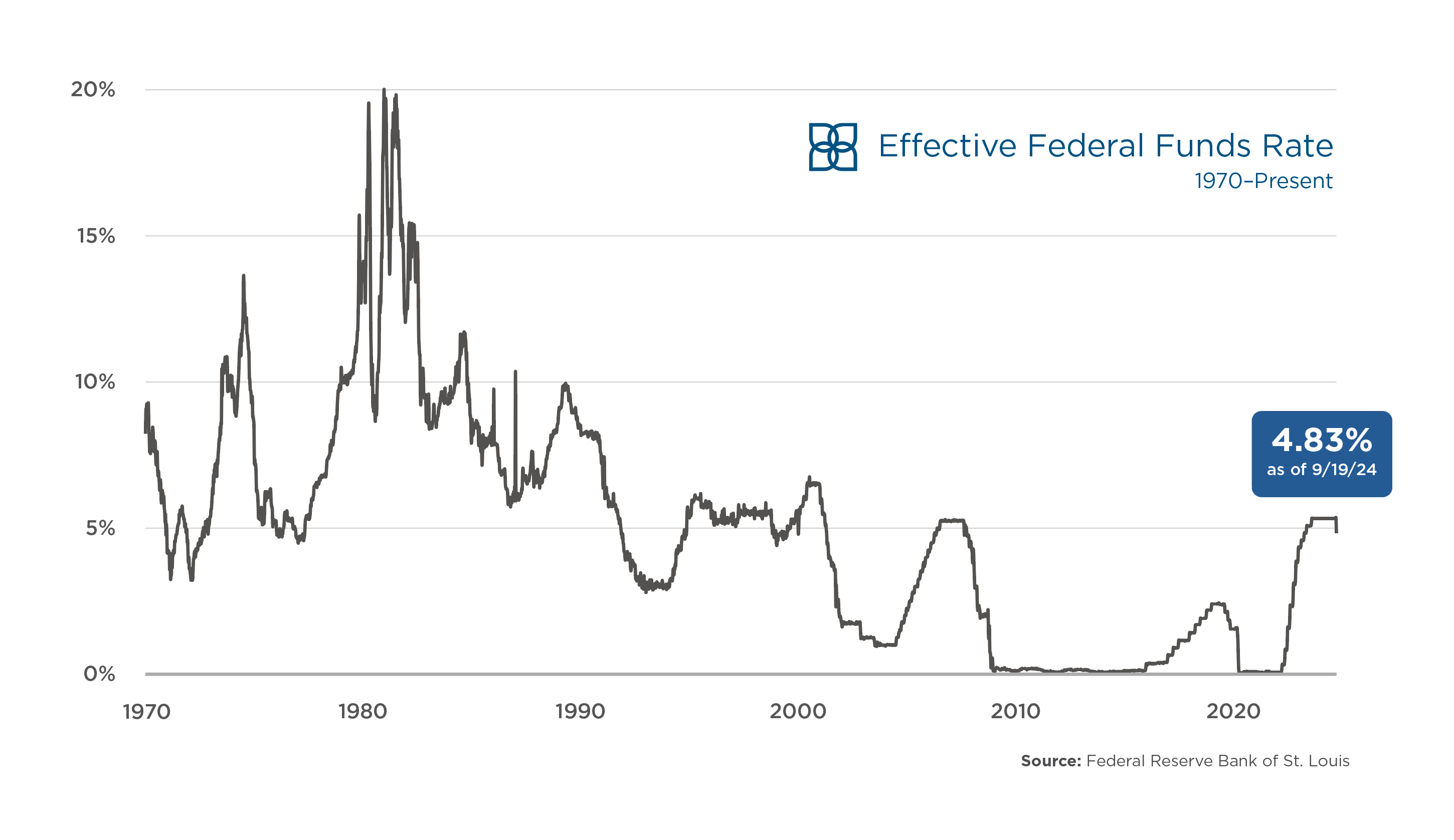

Following the most aggressive tightening cycle in decades, the Federal Reserve’s recent half-point rate cut signals a pivot to easing monetary policy. Chairman Powell’s statements also seem to support broad expectations for two additional cuts of at least a quarter point each before year-end.

The question for our industry is how the change in the Fed’s stance will impact hotel real estate lending and transactions going forward. Although the pricing and availability of hotel debt has meaningfully improved over the past several months, especially in the CMBS markets, the hotel transaction market has remained sluggish at best.

Momentum Is Building

- The Fed has signaled a pivot to easing monetary policy

- Two more cuts are expected this year

- Optimism is baked into investment underwriting

- Vast investment capital is eager to be deployed

- Transaction activity will accelerate

- The present is an ideal time to launch a hotel sales process

Effects of Rate Increases Have Been Palpable

After two decades of historically low interest rates, the Fed’s dramatic hike to curb inflation was a stinging blow to hotel real estate. In only a few months, owners saw debt service payments effectively double, valuations of their assets pushed lower, and refinancings made much more challenging and expensive. Despite the vast amount of investment capital waiting on the sidelines, hotel deals have been few and far between. Lower valuations caused owners to be reluctant to sell, especially if they had lower-rate debt in place. Properties brought to market often received disappointingly low bids as buyers underwrote much higher debt costs or could not secure debt at all.

Hotel investors have anxiously awaited the Fed’s move, as the Federal Funds Rate directly affects bank borrowing rates and lending benchmark rates, most notably the Secured Overnight Financing Rate (SOFR). The Fed Funds Rate and SOFR are highly correlated, and SOFR typically mirrors any change by the Fed in short order.

As the benchmark rate for most existing hotel loans increases or decreases, hotel debt service payments are immediately impacted. Lower debt service improves hotel cash flow and, in turn, valuations. On the other hand, lending rates for new hotel loans often lag changes in SOFR and are also sensitive to broader economic conditions. So, the recent half-point cut might not immediately improve hotel lending. Many reports suggest that a cumulative Fed cut of 100 to 150 basis points would be required to resonate in the hotel transactions market.

Optimism On The Rise

Our firm has adopted a more positive view based on our direct discussions with hotel owners, buyers, and lenders. These conversations suggest growing optimism and a desire to get back into the game. This initial rate cut signals that the worst may be behind us. Although rates may not come down as fast as they went up, and they may not ultimately return to the historically low levels of the last decade and a half, the pivot by the Fed brings more clarity to the market. The path to easing monetary policy appears to be in place, and hotel owners and investors have begun to bake this optimism into their underwriting. Furthermore, lending is expected to get easier, especially for hotels as a preferred asset class compared to office and retail.

Transaction activity will accelerate more quickly as more owners decide to bring assets to market with eager capital ready to buy. Momentum is building.

We believe the present is an ideal time to launch hotel dispositions. The debt environment is no longer an impediment to transacting, and there is an unprecedented amount of equity capital primed for deployment. Perhaps most importantly, because there are so few assets on the market today, every opportunity receives full investor attention, and competition is high for high-quality properties. We expect that dynamic will change as more properties hit the market through the fourth quarter of 2024, into early 2025.

If you’re contemplating a disposition or looking to acquire a property, leverage The Plasencia Group’s thirty-one years of hospitality market expertise and industry-leading know-how. Reach out to one of our team members today to start a discussion on how we can help you achieve your hospitality investment objectives.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt in to our news and communications list.