August 15, 2024

Download a PDF version of Market Insights – Boston Lodging Market: Resilience & Recovery

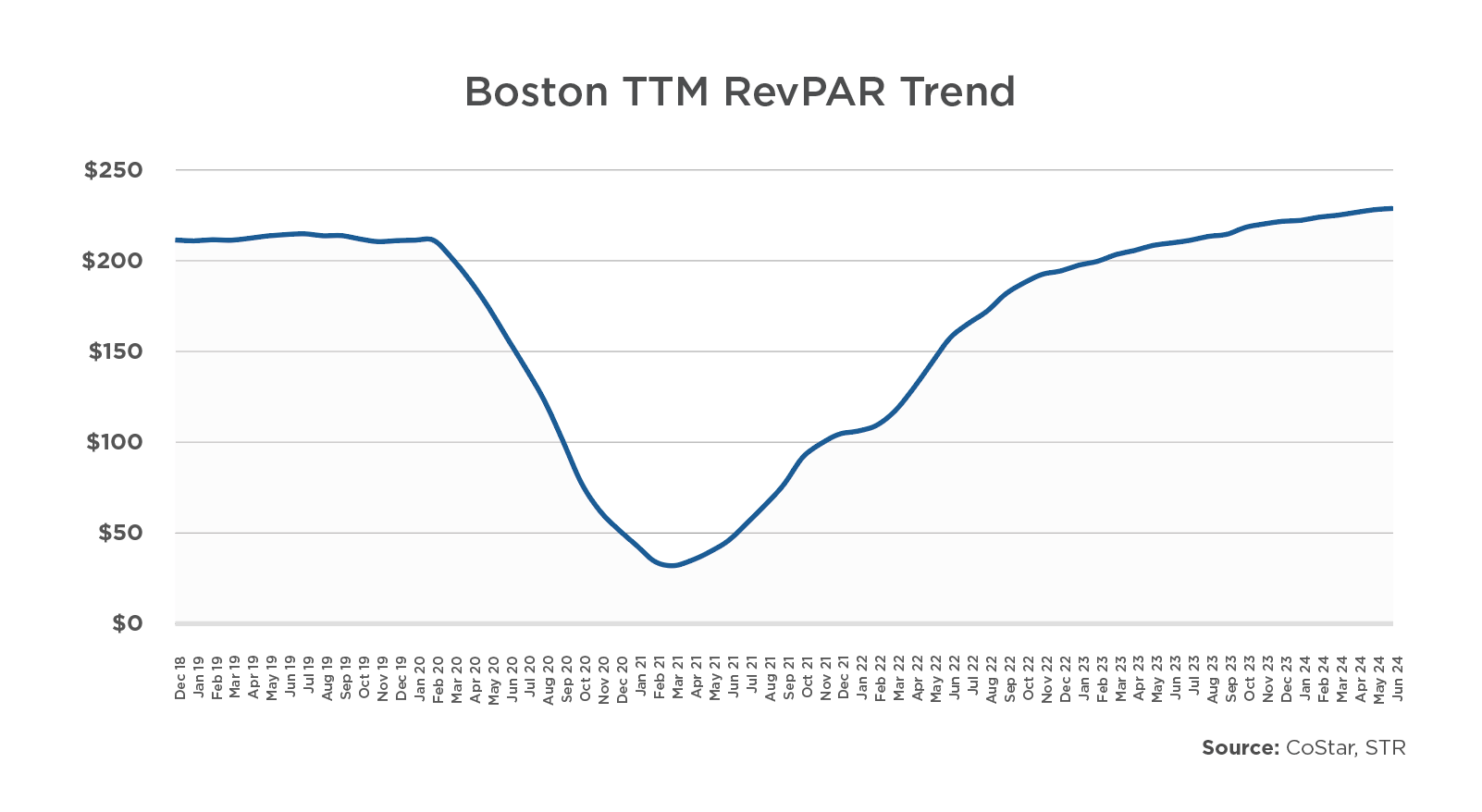

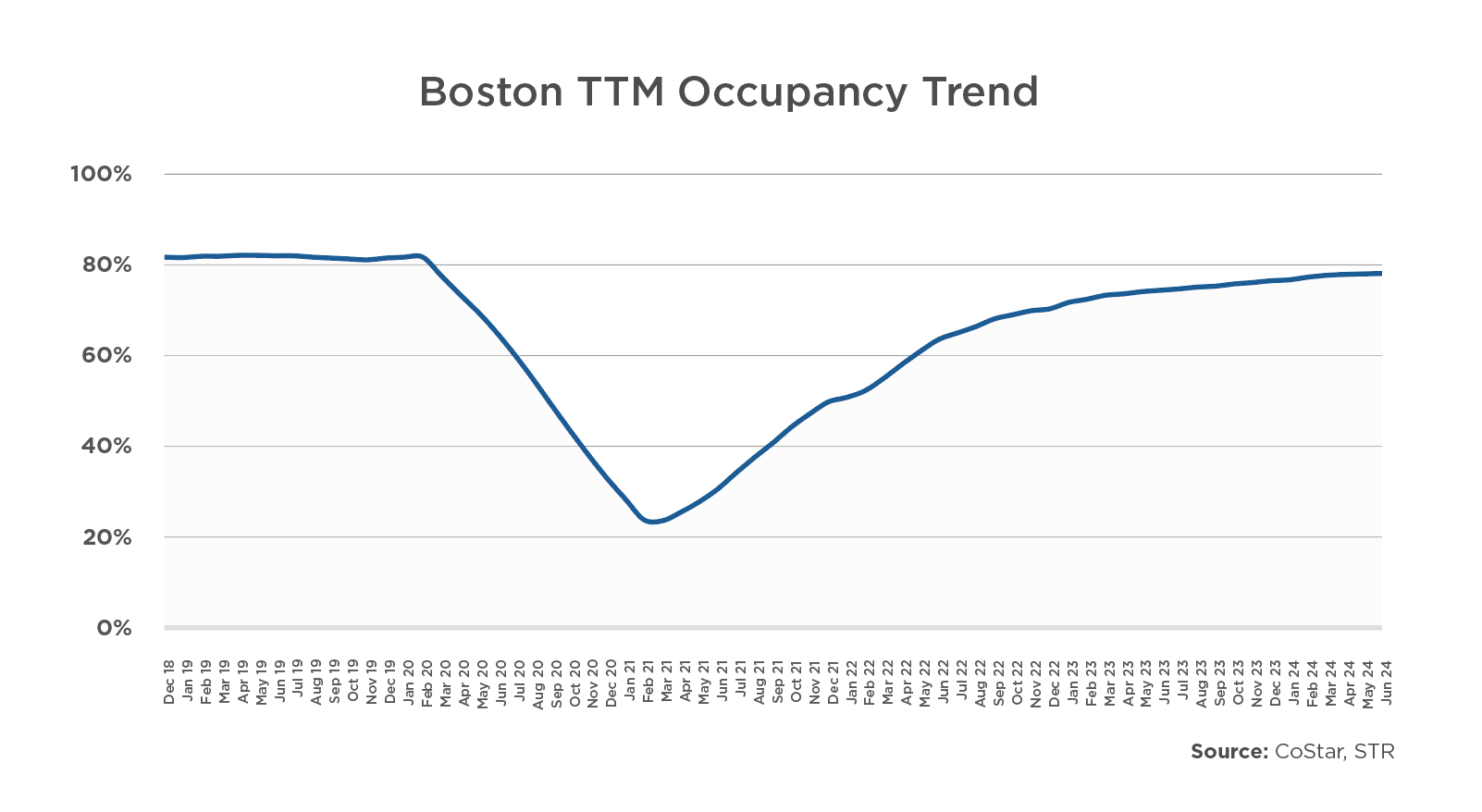

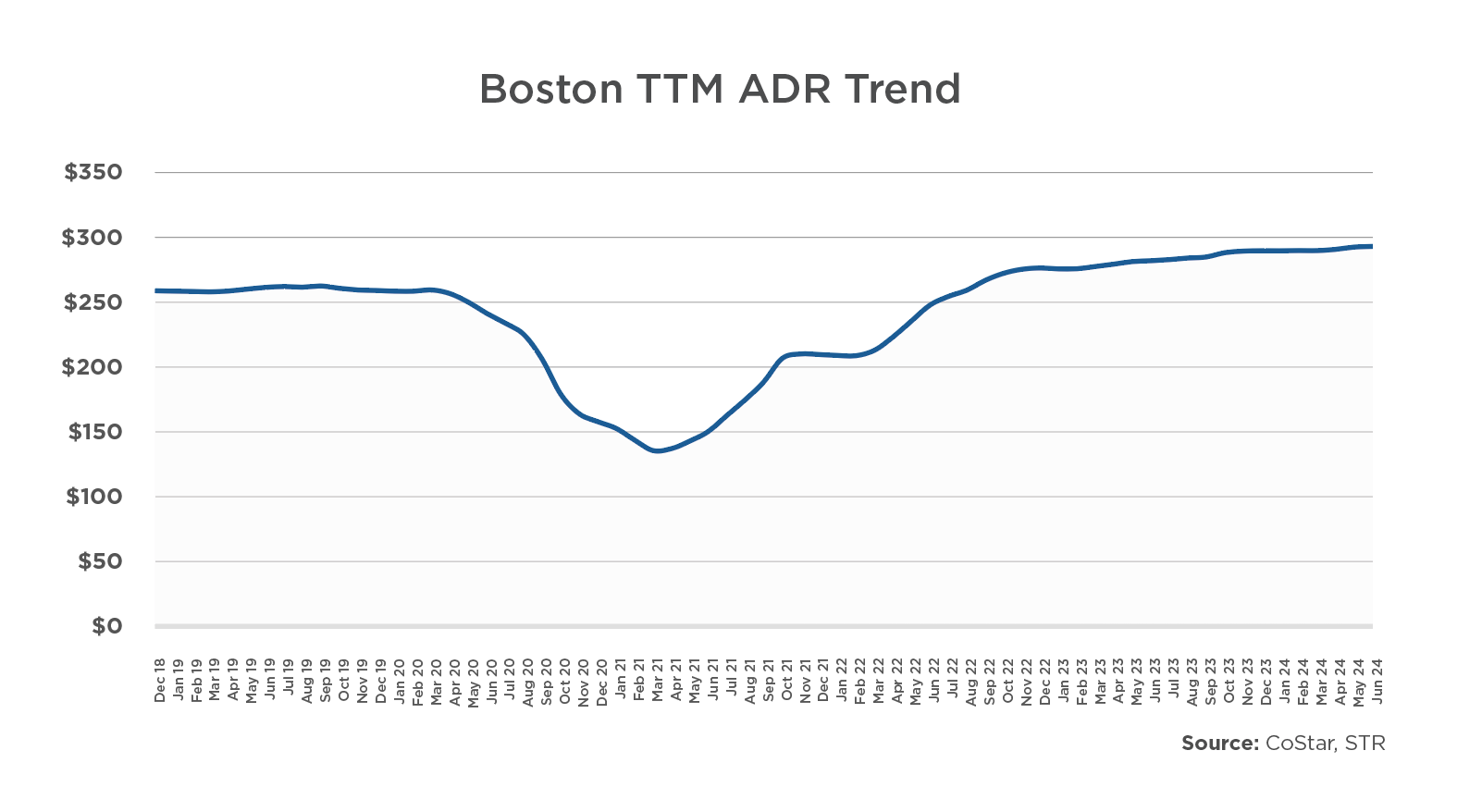

Like many cities unable to immediately benefit from the post-pandemic boom enjoyed by many sunbelt destinations, Boston’s lodging recovery took longer to evolve. Not long ago, we commented that the pandemic hit Boston’s historically vibrant hospitality economy early and hard, plummeting hotel occupancy to almost zero and closing many hotels for over a year. At one point, Boston was the worst-performing of the Top 25 lodging markets tracked by STR.

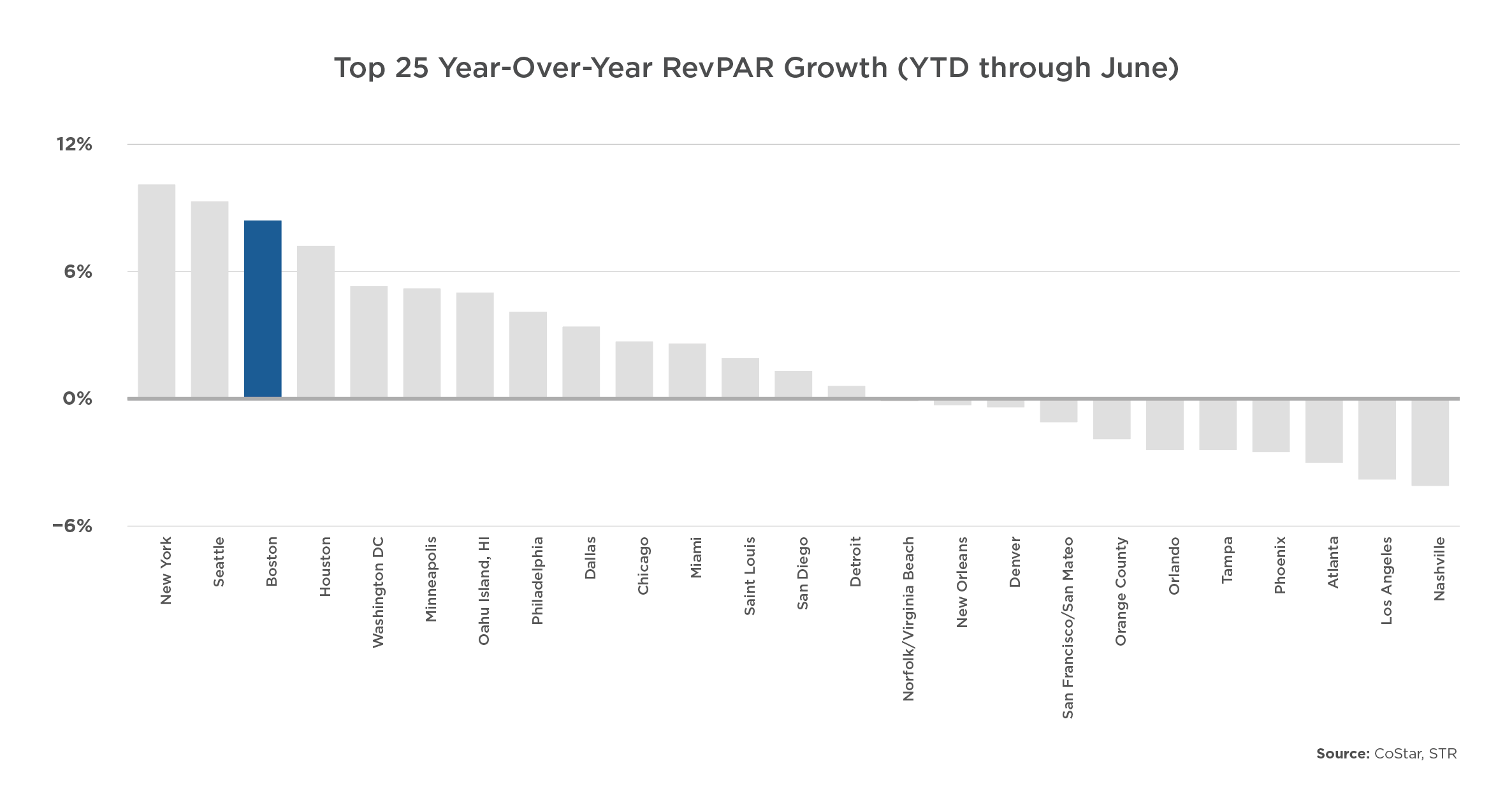

Despite the challenges and a slow start, the Boston market’s resiliency was demonstrated by a surging recovery in 2023 that continued into the first half of 2024. In the June 2024 year-to-date period, the Boston market achieved RevPAR growth of 8.4%, the third highest among the top 25 lodging markets tracked by STR.

Boston’s June 2024 YTD RevPAR is 7% higher than the same period in 2019. Although 2024 YTD occupancy lags 2019 YTD by 5%, ADR is outpacing 2019 levels by 12%.

A Diverse Foundation of Demand Generators

Boston’s diverse foundation of lodging demand generators, including tourism, meetings, conventions, education, medical, life-science, and business travel, is critical to the market’s resiliency. In particular, a strengthening convention calendar following the opening of the 1,054-room Omni at the Seaport in September 2021 and a healthy revival of air travel capacity and passenger volume at Logan International Airport have helped fuel the market’s recovery. The Boston Convention & Exhibition Center had a record year in 2023, and the event calendar continues to be strong. A resurgence of international airport traffic has especially benefited Boston’s tourism, convention, and business sectors.

Airport Volume Continues to Improve

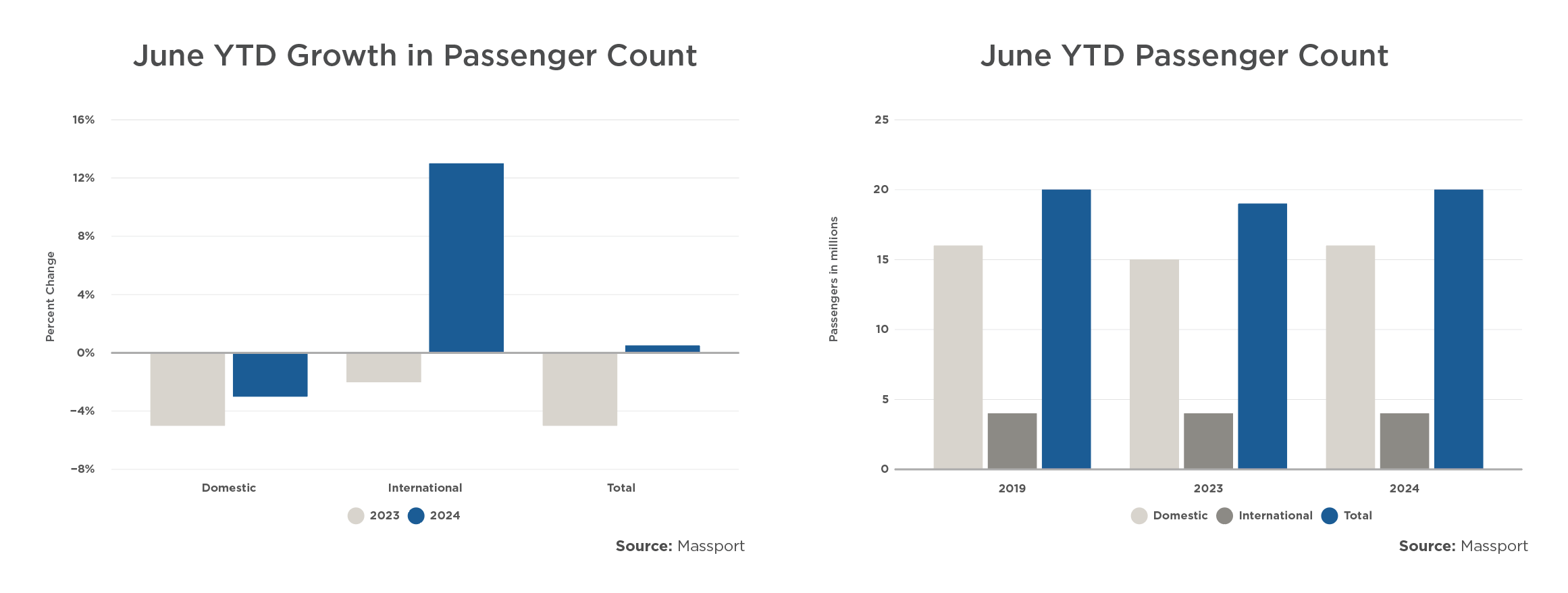

International travel has led Boston Logan International Airport’s recovery in the wake of the pandemic. International travel has rebounded to new heights following the reintroduction of the airport’s Terminal E, which was modernized at a cost of $640 million and reopened in November 2023. The project expanded the international terminal to 390,000 sq ft, adding four additional gates and new amenities.

This year through June, international activity at Logan approached 28,000 flights, 4% more than scheduled in June 2019 YTD. More importantly, international passenger volume is up 13% through June this year compared to the same period in 2019. This booming international has paced the airport as domestic travel continues to bounce back. The significant revival of international travel is also essential in sustaining Boston’s lodging market recovery.

Supply and Demand Dynamics Bode Well for the Foreseeable Future

While most demand segments have recovered or are on a solid path to do so, business travel continues to lag, and its future remains to be determined. A “return to the office” culture appears weaker in Boston than in other urban centers. According to the Bureau of Labor Statistics (BLS), white-collar employment is declining in Boston. Office-using jobs dropped 1.2% in the Boston metro in Q1 of this year, and several sources report current office vacancies of 20-25%.

Mitigating some of the drag from weaker business travel demand is the favorable outlook for new supply impact. Recent additions to hotel inventory include the previously mentioned Omni, the 147-room Raffles that opened in September 2023, and the soon-to-open CitizenM Back Bay with 380 rooms. Overall, room inventory was reduced in 2023 when 428 rooms in the south tower of the Sheraton Boston were converted to student housing for Northeastern University.

The new construction pipeline is minimal and constrained by higher debt and construction costs, and very few sites available for development. Boston currently ranks 20th in total future hotel room pipeline of the Top 25 markets, as reported by STR. Most pipeline projects are in the early planning stages and will likely take years to come to fruition. This bodes well for continuing a favorable supply and demand dynamic in the market for the foreseeable future.

Boston Is Back

The bottom line is Boston is again showing its historical resiliency. Despite some challenges and lagging business travel demand, Boston’s diverse demand base and positive fundamentals should provide a solid foundation for a sustained recovery. As debt markets and investor sentiment eventually improve, we expect Boston to be high on the list for those pursuing acquisitions of hotel properties.

If you’re contemplating a disposition or looking to acquire a property in Boston, let The Plasencia Group team leverage our over thirty-one years of market expertise and Northeast know-how. We invite you to get in touch with one of our Investment Sales team members today to discuss how we can help you achieve your investment objectives.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.