March 14, 2023 – By John Plasencia, Managing Director

Review and download the PDF version of Hospitality Industry Insights – Examining the DFW Metroplex Through the Lens of Its Top RevPAR Hotels

The DFW Metroplex’s hotel scene experienced an inflection point in 2022. The prior couple of years saw hotel performance decimated due to the pandemic, raising questions about the viability of certain submarkets, especially those reliant on corporate and group business. For better, or in a few cases, for worse, a lot of these questions were answered in 2022.

While the market has plenty of depth to its supply, the performance of hotels at the market’s top end is informative about the current state and future potential of certain submarkets and product types.

While the market has plenty of depth to its supply, the performance of hotels at the market’s top end is informative about the current state and future potential of certain submarkets and product types.

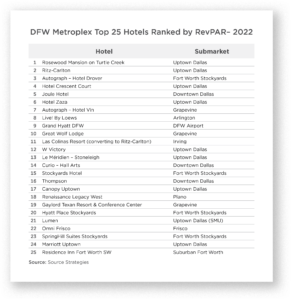

Source Strategies arrives at RevPAR statistics for individual hotels by extrapolating from Texas State Comptroller records of hotel room revenues throughout the state. The following ranking of the top 25 RevPAR-generating hotels in DFW for 2022 was compiled using this RevPAR data from Source Strategies.

Uptown Dallas Continues to Shine

Not surprisingly, Uptown Dallas is well-represented among the top RevPAR hotels in North Texas. The continued commercial development in the corridor along McKinney Avenue has made Uptown what is arguably the most desirable submarket in the area across all real estate types. Uptown also has the highest concentration of high-end lodging product in the Metroplex, headlined by the Mansion on Turtle Creek (#1), Ritz-Carlton (#2), Crescent Court (#4), and ZaZa (#6). Strong initial results at newer, non-luxury product in Uptown, such as the Canopy (#17) and the Marriott (#24), also serve as indicators of the escalating demand in the submarket. That demand will be tested by incoming supply in the area, but pending major office and residential developments should also ensure that demand will grow more than commensurately with supply in the years to come. Downtown Dallas does not currently benefit from the luxury supply that Uptown offers, limiting high-end RevPAR. The HALL Arts (#14) and Thompson (#16), both of which are relatively new, have performed solidly out of the gates, but the still-recovering corporate and group demand segments in Downtown have limited the submarket’s RevPAR.

Bleisure and Leisure Appeal is Apparent in Suburban Submarkets

The presence of some major group hotels on the list is a quite promising sign for the market. It is especially telling that the higher RevPAR, group-heavy hotels that appear on the list benefit from a leisure component in addition to ample conference space. The Live! by Loews (#8) in Arlington sits in the Texas Live! development in the sports district that is home to AT&T Stadium and Globe Life Field. A new 888-key Loews is currently under construction adjacent to the current Live! by Loews and will only increase the appeal of the complex to large groups. The Gaylord (#19) in Grapevine is a convention destination in and of itself and sits on the banks of Lake Grapevine. Other suburban hotels on the list include the Hotel Vin (#7), a F&B-centric boutique hotel in charming Downtown Grapevine; Great Wolf Lodge (#10), a family-friendly resort and indoor waterpark; and Las Colinas Resort (#11), a former Four Seasons converting to Ritz-Carlton that offers an incredible golf package and resort amenities. The ability for guests to mix business with pleasure is proving to be critical for the success of area hotels.

Stockyards are the Place to Be in Fort Worth

Four hotels in or near the Fort Worth Stockyards are in the top 25, highlighted by the Hotel Drover (#3), which is probably the most talked-about hotel in the Metroplex. The Drover is the embodiment of what makes the Stockyards so attractive – the seamless integration of distinctive Western elements with the modern aspects of a major city. The Stockyards and the adjacent Mule Alley complex offer an unparalleled cultural experience, from daily cattle drives, to high-end boutiques and Western wear shops, to Billy Bob’s Honky Tonk, to gourmet restaurants, to a world-renowned rodeo facility. The lodging business these demand generators attract is made evident not only by the performance of the Drover, but also that of the nearby Stockyards Hotel (#15), Hyatt Place (#20), and SpringHill Suites (#23).

Corporate Suburbs Slower to Bounce Back

Before the pandemic, Plano, Frisco, and Southlake were among the hottest corporate submarkets in the country, let alone the state. However, given the somewhat one-dimensional nature of these and other similar suburban submarkets, hotel performance has not fully rebounded. The only exceptions are those that offer somewhat of a leisure component, like the Renaissance Plano (#18), which sits in the appealing Legacy West entertainment and retail district, and the Omni Frisco (#22), which is adjacent to the Dallas Cowboys’ headquarters and the buzzy Star development. The confluence of an influx of supply before, during, and after the pandemic and muted corporate demand makes it difficult for certain suburban hotels to push RevPAR. That said, with the ongoing return-to-office momentum, it seems to be a matter of when, not if, corporate demand returns to buoy those submarkets.

For more valuable hospitality industry news and market analysis, or if The Plasencia Group may be of assistance at any point throughout the entire life-cycle of your hotel, resort or property portfolio investment, please call us directly at (813) 932-1234.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.