March 21, 2023 – By Dexter Wood, Senior Managing Director

Review and download the PDF version of Hospitality Industry Insights – The Hotel Debt Quagmire Deepens

Hotel owners and investors hoping a more favorable lending environment was on the horizon were just thrown a curve ball. The threat of a growing banking crisis has pushed challenging hotel lending conditions to new depths. Many borrowers with maturing hotel loans face even greater mounting pressure and even fewer viable solutions.

A Year of Mounting Uncertainty

For over a year, rising interest rates, high inflation, fears of an impending recession, and the potential for an escalating war in Ukraine have fostered a general state of unease and uncertainty. These conditions have served to stall debt markets and stifle lending activity as lenders have found it difficult to price risk and appropriately underwrite loans.

The recent failures of Silicon Valley Bank and Signature Bank, the emergency acquisition of Credit Suisse by UBS, and mounting concerns regarding the health of other banks such as First Republic Bank, have rattled already fragile financial markets and exacerbated many aspects of the troubled lending environment.

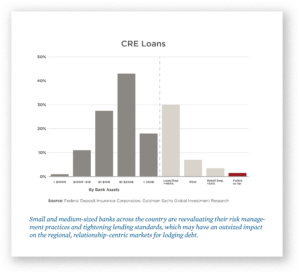

Goldman Sachs recently reported that small and medium-sized banks play a critical role and account for 80% of commercial real estate lending. For the lodging sector, regional banking system activity is pervasive and serves as a primary source for new construction loans in addition to traditional lending. Maintaining the stability and health of regional and local banks is crucial to the continued growth of the lodging industry and the ability of many owners, developers, and investors to finance projects successfully.

The Far-Reaching Impacts of the Fed’s Next Move

The response to this unfolding situation, most notably the course that the Federal Reserve Bank decides to chart, will have meaningful and far-reaching impacts on lending, commercial real estate, and the broader economy. The Fed raised interest rates seven times last year and again this past January, bringing the federal funds rate to between 4.5 percent and 4.75 percent. At the time of this writing, speculation is building as we await the Federal Open Market Committee’s March 21-22 meeting and a decision on whether to continue raising interest rates to battle inflation. The Fed is facing several conflicting issues. On the one hand, many sectors of the economy are strong, and unemployment is low, yet inflation reportedly remains exceedingly above the Fed’s target rate. At the same time, a decision to continue raising rates to battle inflation could also intensify problems and weaknesses in the banking system.

CMBS Loan Maturities Loom

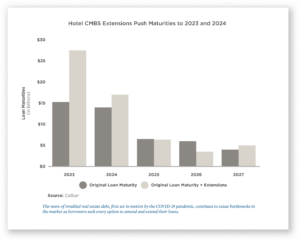

In the shadows of this turmoil, a significant log jam of maturing and troubled hotel real estate debt has yet to be adequately resolved. In fact, the problem continues to grow. According to CoStar Risk Analytics, $23 billion of lodging CMBS loans scheduled to mature before this year remain outstanding. Approximately 79% of those loans were extended to 2023, and another 10% were pushed to 2024 or later. The remaining 11% were either placed in special servicing or scheduled to be paid off. As of year-end 2022, just under 7% of all hotel CMBS loans were in special servicing.

CMBS loans represent only a small portion of the overall lending on hotel properties. Still, they indicate the sizable amount of maturing debt looking to be refinanced or recapitalized, notwithstanding rapidly worsening debt markets and lending conditions. Unfortunately, many owners face near-term maturities and cannot wait for the debt markets to improve meaningfully.

Rising Rates Complicate Refinancing

Rising interest rates are causing another significant challenge for many hotel owners with floating-rate debt or attempting to refinance a loan. The cost of interest rate “cap” protection has exploded over the past year. Many borrowers who purchased caps before the Federal Reserve’s aggressive hiking of interest rates are now faced with expiring caps, and the cost to replace them has increased by five- or six-fold. Interest rate protection is often a condition of the underlying loan, and failing to have a cap in place might trigger a default. Interest rate caps are now effectively a component of elevated overall borrowing costs that create even more financial pressure for hotel owners.

The hotel debt quagmire has deepened as recent events have weakened confidence and established more reasons for uncertainty. The result is fewer alternatives for owners pressed to find solutions for refinancing maturing loans and replacing interest rate caps and other obligations. Most options will likely require additional capital in the form of fresh owner equity, bridge loans, preferred equity investment, or another form of gap financing. These alternatives may be expensive in the short term, but allow an owner to buy some time to consider better options once market conditions improve.

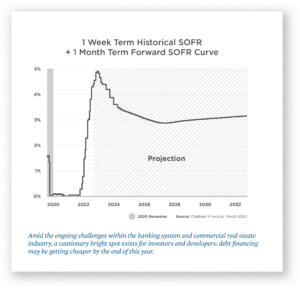

Having communicated for months that they would leave interest rates at 5% or higher for a sustained period of time to combat inflation, the Fed now faces pressure to cut rates in the face of perceived turmoil within the banking system. As indicated by the forward SOFR curve, market participants expect multiple rate cuts in the near-term. Should this be the case, borrowers will hopefully see better financing opportunities sooner than expected.

In some situations, a sale of the hotel or resort may provide the best, or often the only outcome for many distressed owners. As we have learned by living through several similar financial cycles, exiting the asset can provide for a fairly expedient route to repayment of outstanding debt and alleviating stress on the owner and the operator. If The Plasencia Group’s team of seasoned veterans may be of assistance with your financing or disposition needs, we stand ready.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.