Why Tampa Bay Area Hotels Are Attracting Buyers

by Frances McMorris (Tampa Bay Business Journal)

View PDF Version

_____________

Lack of Tampa Bay hotel supply means new buyers, development opportunities

While it’s a good time to acquire a hotel in Florida, it’s an even better time to snatch one up in the Tampa/St. Petersburg area.

That’s the conclusion of Lou Plasencia, chairman and CEO of Tampa-based hotel advisory firm, The Plasencia Group. The Tampa/St. Pete region “is one of the more attractive areas to invest in right now,” Plasencia said in an interview with the Tampa Bay Business Journal.

“We expect higher than average activity over 36 to 48 months on waterfront properties,”he said. “It’s hard to replicate or build waterfront hotels. Those on the water will continue to be highly sought-after products, not only in Tampa but all over Florida. There are already properties on the market and more will come on the market.”

But, what makes purchasing hotels in Tampa and St. Pete particularly attractive is the lack of supply.

Cities like Miami and Orlando have seen hotel construction soar in recent years.

Not so in the Tampa Bay area where most of the new rooms will be concentrated primarily in two of three larger hotels such as the 519-room JW Marriott that will be built as part of the $3 billion, mixed-use Water Street Tampa project in downtown Tampa, being developed by Strategic Property Partners, the real estate company controlled by Tampa Bay Lightning owner Jeff Vinik and Cascade Investment LLC. Downtown St. Pete has almost no new supply except for smaller, select service properties, Plasencia said.

In fact, among the top 25 hotel markets, the Tampa Bay region is at the bottom in terms of supply. Markets like New York City, Chicago, Nashville and Orlando are seeing huge increases in hotel rooms and properties of anywhere from 7 percent to 20 percent, Plasencia said.

All the new rooms added to the hotel inventory in those markets make it difficult for existing hotels to push rates and increase profitability.

With so few new hotels being built in the Tampa Bay region, properties instead are changing hands or undergoing renovations. For instance, the 287-room Hyatt Regency Clearwater Beach Resort & Spa finished an extensive, multimillion-dollar renovation to its guest rooms, meeting and event spaces, and public areas

in January.

Among the properties being bought was the 293-room Renaissance Tampa International for $68 million or $232,000 per key by Clearview Hotel Capital of Newport Beach, California and funds managed by Oaktree Capital Management L.P. (NYSE: OAK), a global investment management firm based in Los Angeles.

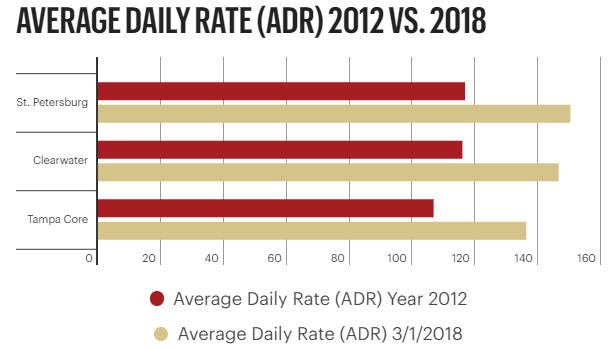

The transaction reflects that fact that price per key has improved mightily over the last 24 months, with properties in Pinellas County setting records, Plasencia said.

Just last year, Bethesda, Maryland-based Host Hotels & Resorts (NYSE: HST) paid $214 million for the historic 277-room Don CeSar and the 70-room Beach House Suites by Don CeSar in a deal that breaks down to $616,700 per key.

Those purchase prices also illustrate another phenomenon.

Over the last five years, the number of institutional owners has increased by 50 percent, spreading out from local and regional investors to firms in New York, Chicago and Los Angeles, Plasencia said.

Tampa and its hotel market, he said, “is on everyone’s radar right now.”