May 20, 2024

Download a PDF version of Market Insights – New Orleans Hotels Put Lackluster 2023 in Rearview

Our firm has been highly active in the New Orleans hotel market and has sold dozens of hotels in the Big Easy over the years. We’ve had an up-close vantage point of the market’s peaks and valleys. While black swan events like Hurricane Katrina and the COVID-19 pandemic had obvious and lasting impacts on New Orleans itself, each in turn nearly obliterating room night demand, the reasons for underperformance in 2023 were less straightforward. It is clear that the market has largely moved on from the struggles it experienced in 2023, with lodging demand steadily improving.

Reasons for Optimism in 2024 and Beyond

2024 is proving to be much, much different, with CoStar/ STR projecting the market’s RevPAR to improve by approximately 5% for the year. Similar growth is expected in 2025. There are several reasons for this resurgence:

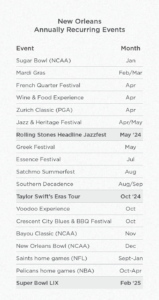

Robust Event Schedule

The festivals and events that New Orleans is famous for, from Mardi Gras to Jazz Fest to Essence Fest to French Quarter Fest to the Bayou Classic to the Sugar Bowl, are back in full swing. In addition to the typical schedule of annual events, in 2024 and early 2025, the city will host the Rolling Stones as Jazz Fest headliner, Taylor Swift’s Eras Tour, and Super Bowl LIX. This extraordinary slate of major events positions the local hotel industry for what may be generational performance and is indicative of New Orleans’ stature as a global entertainment destination.

Leisure and Group Recovery

New Orleans benefits from robust leisure and group demand, the most critical segments of the post-pandemic demand landscape. New Orleans’ leisure segment, which has a large “drive-to” component, was an early driver of the market’s recovery in the immediate aftermath of the pandemic, and it continues to serve as a strong contributor to the market’s demand makeup. The group piece, which was slower to recover in the wake of the pandemic, is coming back with a vengeance, with 2024 and future years featuring crowded convention schedules. The Convention Center’s ongoing redevelopment and the pending temporary closures of regional competitors in Dallas and Austin will only accelerate group demand across New Orleans.

Limited New Supply

The CBD/French Quarter area of New Orleans is a highly developed commercial real estate submarket, with hotel development completely banned in the French Quarter and very few pieces of land available for development in the CBD. The submarket also has a mature hotel landscape, with virtually every major brand already represented. Only 598 hotel rooms, representing 1.4% of existing supply, are under construction in the submarket, indicating a stable operating environment for existing hotels.

Market Improvement Begets Investment Opportunities

While the aftermath of the pandemic, including 2023, has been tough for hotels in New Orleans, the market is poised for stabilization and continued RevPAR growth. With a healthy demand environment and limited new supply on the horizon, the legendary hospitality destination has a bright outlook. Many owners of hotels in the market have held their assets beyond their initial investment horizons throughout the pandemic and the recovery, making the present window an appealing time for them to consider an exit. We believe that many owners will take advantage of the improving optics in the city and bring their assets to market in 2024 and 2025, some opting to sell into the Super Bowl, some opting to harvest that cash flow and sell after. If you’re contemplating a disposition or looking to acquire a property in the Big Easy, let The Plasencia Group team leverage our over thirty-one years of market expertise and New Orleans know-how. We invite you to get in touch with one of our Investment Sales team members today to discuss how we can help you achieve your investment objectives.

Over Thirty Years of Client Success

It would be our pleasure to assist you in the evaluation, acquisition, sale, or financing of your properties in the New Orleans area and across the country.

In addition to our investment advisory practice, our firm also provides ownership representation services and development and renovation consulting expertise to hotel and resort owners. If we may be of assistance with any detail of your hotel, resort, or property portfolio investment, please call us directly at (813) 932-1234 to start the discussion.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.