Borrowers with maturing loans have increasingly fewer options

Posted August 25, 2022 – By Dexter Wood

Review and download the PDF version of Hospitality Industry Insights – A Hotel Debt Quagmire.

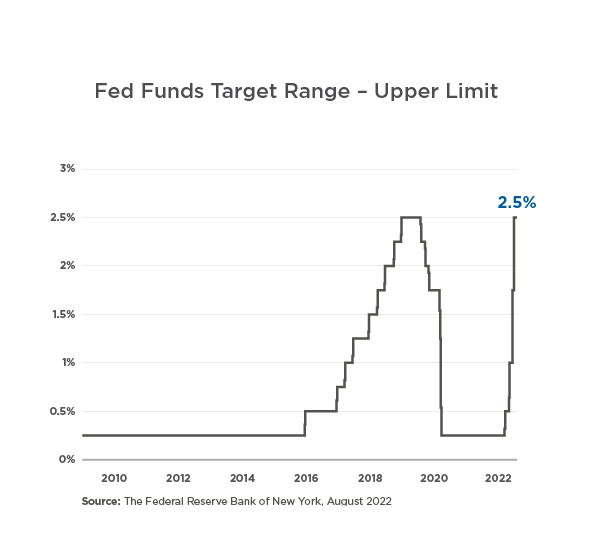

Any optimism for a post-COVID resurgence of hotel lending activity has evaporated as the market stalls in the face of the highest interest rate environment in over a decade. The surging economic uncertainty is undoubtedly impacting the level of angst many hotel owners are feeling at the moment. The magnitude and unpredictability of changing loan underwriting assumptions in the past sixty to ninety days alone have meaningfully increased investment risk.

New Debt Has Vanished

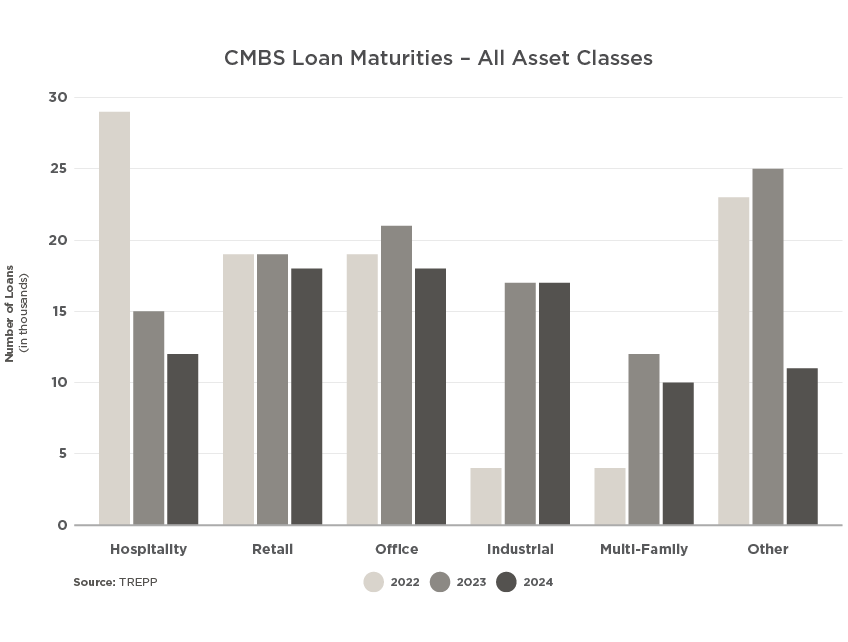

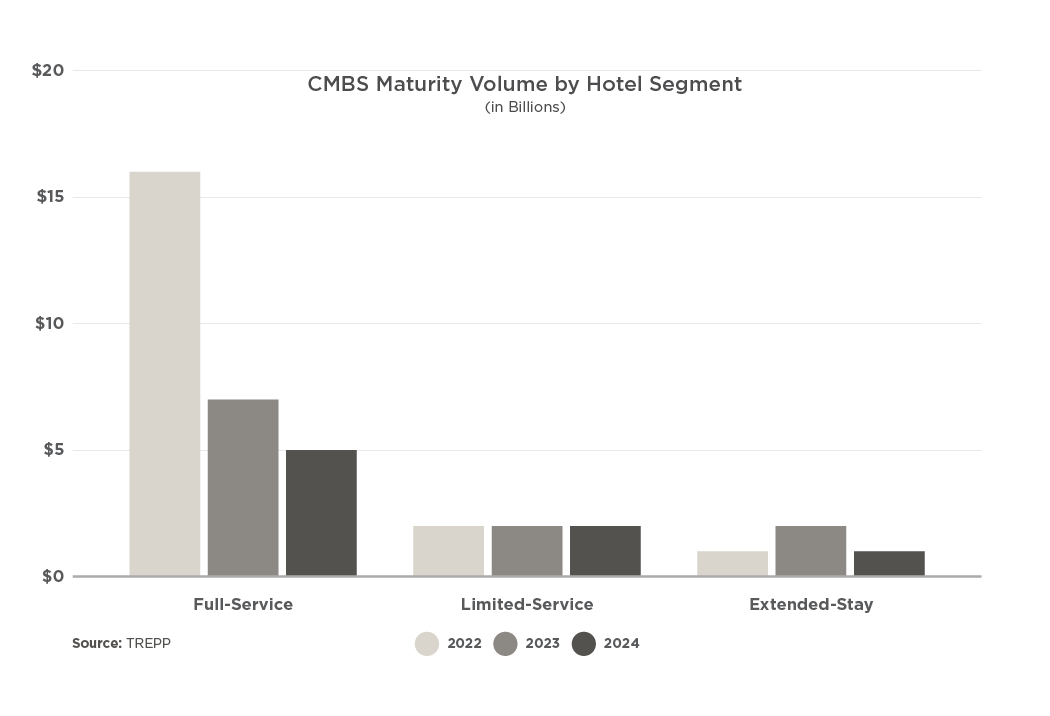

New debt for hotel acquisitions has all but vanished, but a bigger problem may be the wave of existing debt facilities of all types that are scheduled to mature this year and next. Beginning at the start of 2022 and through the end of 2023, nearly 45,000 CMBS hotel loans totaling about $30 billion in value were set to mature as illustrated in the graph at right.

Although the lodging industry has made great progress since the depths of the COVID-19 pandemic, the recovery has proven to be uneven, selective, and vulnerable to a plethora of external factors.

The Post-COVID Lodging Recovery

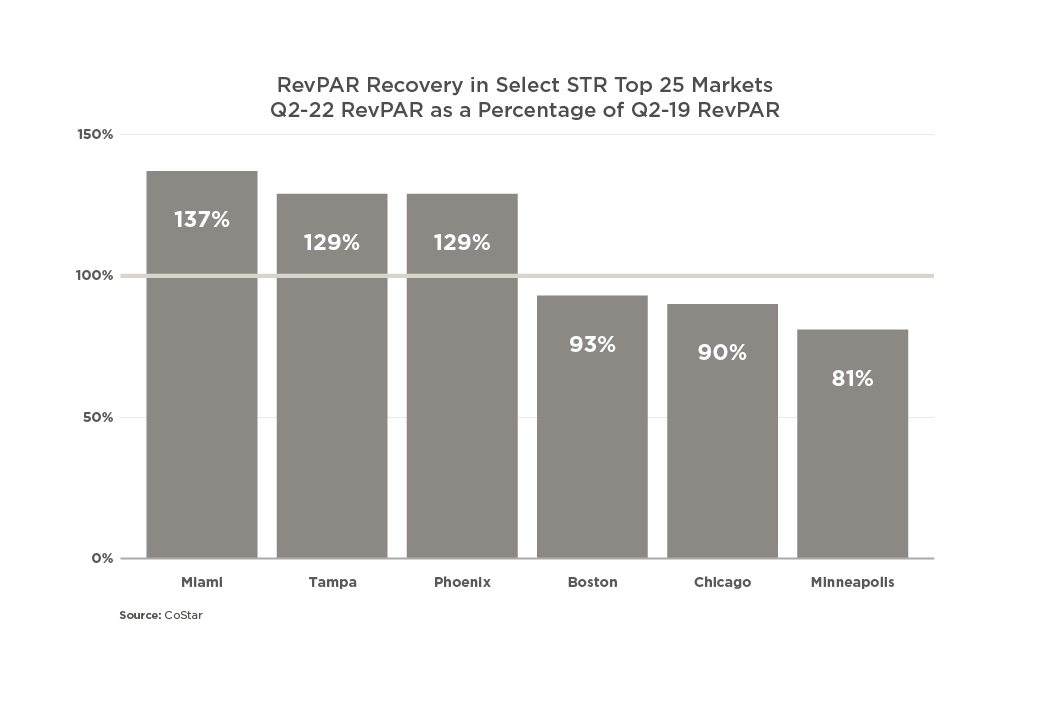

As the reopening of the post-COVID economy unfolded, pent-up leisure demand fueled massive hotel demand at warm and sunny locations, beachfront getaways, and vacation destinations. In fact, many properties located in such markets have exceeded pre-COVID performance levels, but sustainability is now in question. On the other hand, urban markets, especially those in colder locations and those traditionally more dependent on business travel, conventions, and international air travel, have experienced a more difficult and slower path to a recovery that remains ambiguous in many respects.

Those properties fortunate enough to have returned to pre-pandemic revenue levels are now hampered by labor shortages, supply chain constraints and rising inflation. These and other factors are combining to cause an enormous drag on profit margins and cash flow. For many hotels still in the earlier stages of recovery, the current operating environment has become more tenuous and the outlook less well-defined.

This general and widespread uncertainty is meaningfully diminishing the ability to confidently underwrite and value real estate assets and enable transaction and lending activity. Combined with the unwelcome headwind of rising interest rates, a dysfunctional lending market paints a bleak picture for the prospect of refinancing maturing hotel loans.

Loan Maturity Reality

The options for many borrowers facing maturities have quickly become much more difficult and less financially attractive in recent months. Typically, a hotel owner would consider the following straightforward alternatives:

- 1. Extend/renew loan with existing lender

- 2. Refinance loan with new lender; or,

- 3. Sell asset

In the stronger conditions of a normal market, an owner would typically seek to improve investment returns by securing more beneficial loan terms that provide some combination of increased loan proceeds, improved equity value, lower debt service payments, and more lenient loan covenants and controls. An owner might also contemplate an outright sale of the asset if a transaction yielded a price in excess of the loan balance and afforded the opportunity to reinvest sale proceeds elsewhere.

However, for the foreseeable future, the unmitigated impact of the COVID-19 pandemic combined with currently unfolding market dynamics severely complicates these options and encumbers decision making. In many cases, the numbers simply don’t work.

The Valuation Disconnect

In the current environment, numerous properties with maturing debt have an underlying disconnect with respect to their value. Most hotels that suffered closures and negative cash flow during the pandemic are now facing the operational challenges described above, in addition to the need to replenish FF&E reserve accounts and possibly the repayment of forbearance accruals. For these and other reasons, such hotels are unlikely to attain current valuations that equate to pre-COVID appraisal levels or that support the loan-to-value (LTV) ratio required to fully refinance the maturing loan. In some cases, the current valuation may actually be less than the outstanding loan balance, thus requiring additional principal reduction and making a potential sale of the asset impractical.

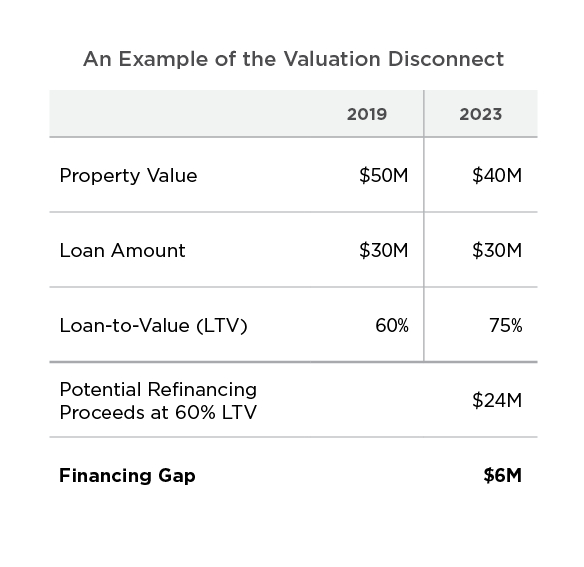

Consider the table at right, which illustrates a hotel property valued at $50M in 2019. A $30M loan placed on the asset provides a reasonable LTV of 60%. Moving ahead to 2023, the asset may currently be valued at $40M if the hotel’s value has been negatively impacted by the COVID-related downturn or any combination of detrimental factors. In this scenario, the LTV increases to 75%, and the possibility of an owner extending or refinancing the maturing loan is unlikely without paying down the loan or accepting lower proceeds. In this example, the financing gap equates to $6M.

Higher Interest Rates Pressure Debt Coverage

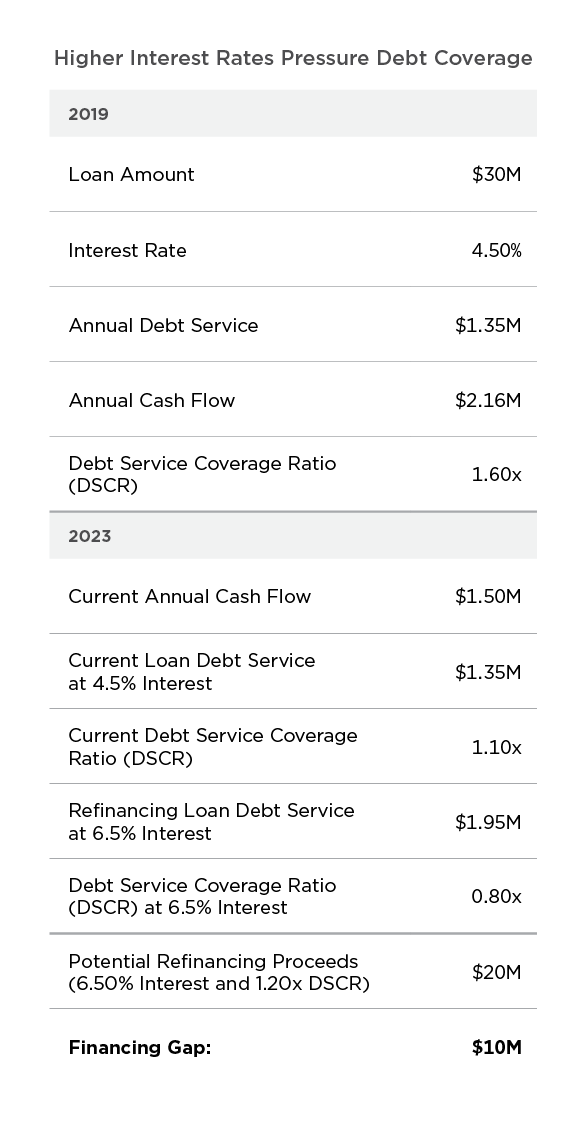

Another significant exposure for owners with near-term maturing hotel loans is that higher interest rates are intensifying the consequences of debt service coverage ratio (DSCR) requirements. A hotel that was profitable pre-COVID may have maintained a DSCR of 1.5x or higher. But today, the same hotel, with the same cash flow but now facing a higher interest rate, might have a DSCR closer to 1.0x on their existing loan. If the hotel’s cash flow remains impaired, the inevitable DSCR challenges are compounded.

Consider the example at right. Like LTV, a lender’s DSCR requirements will also constrain potential loan proceeds and the ability to fully refinance a maturing loan. The example above depicts the same $30M loan on a hotel generating about $2.2M of cash flow resulting in a comfortable DSCR of 1.6x in 2019. Jump ahead to 2023 when, for any number of COVID-related reasons, the hotel’s cash flow may have to have dropped to $1.5M. At the current loan terms, the annual debt service remains $1.35M, but the DSCR is now only 1.1x.

To refinance or extend this loan, a borrower faces two significant problems. The hotel’s cash flow does not support a DSCR that would likely be required by the lender, and higher current interest rates exacerbate the deficiency. Assuming interest rates have risen to 6.5% and that a lender would require a minimum DSCR of 1.2x, the hotel’s expected cash flow can only support new loan proceeds of $20M, resulting in a $10M financing gap.

Facing Difficult Choices

These simple examples demonstrate the likelihood that some hotel owners will need to provide or source additional capital to bridge unavoidable financing gaps when seeking solutions to maturing loans. It is also important to consider the overhang of additional capital needs, including the replenishment of FF&E reserves, deferred CapEx, required brand standards, and other obligations.

Certainly, these examples are not representative of every hotel and every owner anticipating a loan maturity. Circumstances vary widely and market conditions continue to change unevenly and, in some cases, unexpectedly. Many lenders may elect to continue “pretend and extend” policies to buy time and avoid the complexity and burdens of workouts and foreclosures. However, rising interest rates and challenging market conditions are making extensions difficult and more selective. Most examples involve relationship lenders, well-capitalized sponsors, and assets with limited or no impairment.

Some owners with maturing loans may face difficult choices. A hotel lending quagmire provides fewer mitigation options, and the available options are likely to require the contribution of fresh capital in the form of new owner or investor equity, bridge loans, preferred equity investment, or another form of gap financing. In some situations, a sale of the asset may be the best possible outcome.

For more valuable Hospitality Industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.