Posted June 23, 2021

Lodging investors seeking objective valuations and advice

Unprecedented investor interest in the lodging space means competition is likely to be fierce as more assets across the chain scales are brought to market. Investment firms of all types are feeling the pressure to underwrite potential acquisitions under shorter timeframes and with greater urgency from their equity sources seeking to deploy capital as well as from sellers.

Many astute investors are turning to advisors for assistance with analyzing potential capital investments and acquisitions. Benefits of working with an objective third party include:

- Unvarnished, unbiased advice

- Professionally-vetted financial projections and models

- Comprehensive market and submarket analyses

- Thorough competitive property analyses

- Property condition assessments and future CapEx estimates

- Expert negotiation and transaction facilitation

- Access to additional capital sources and key vendor relationships

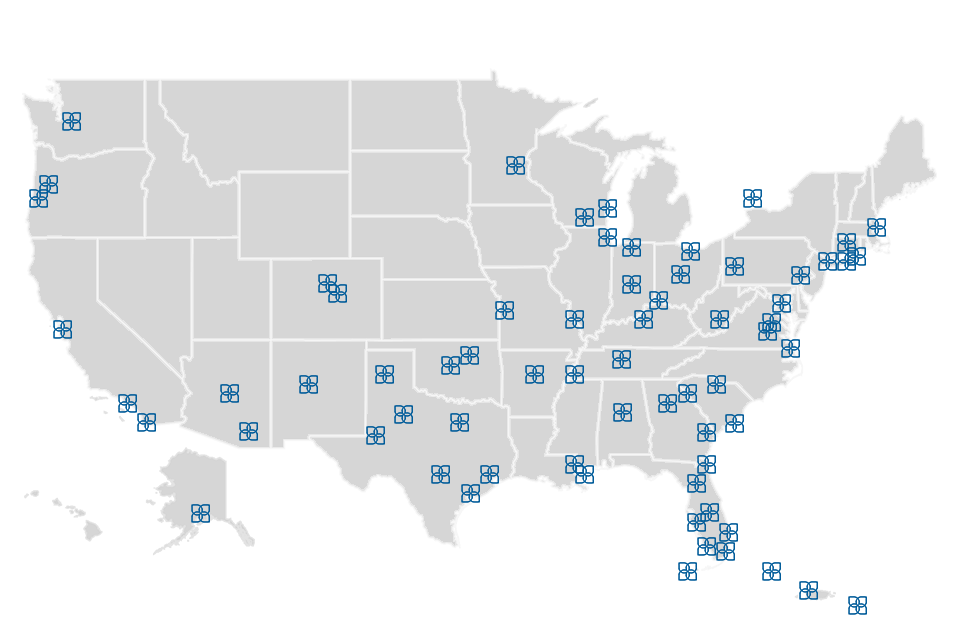

The Plasencia Group offers years of experience in underwriting complex hotels and resorts. We’ve successfully helped clients with their acquisitions time and again, from pre-purchase due diligence, through negotiations and closing the transaction, to post-acquisition value-add projects and more. These clients include private equity firms, family offices, high-net-worth individuals, and institutional real estate investors. More information about the services we provide can be accessed by clicking the link below:

It would be our pleasure to review your current portfolio, investment criteria and target acquisitions, and we look forward to putting over three decades of experience to work for you on your next hotel or resort investment!