Summer 2019 Lodging Investment Roadmap

Posted August 26, 2019

The lodging investment world remains as fast-paced and exciting as ever before, with news abound of new brands, non-traditional competitors, regulatory changes, and of course transactions. As we look ahead to the final few months of the year, we continue to expect an uptick in transaction activity before year’s end as owners of many types seek to harvest their gains as they anticipate end of this extended cycle. When that end will be no one knows, of course, but many agree that we are even closer to the end of our industry’s growth phase given the challenges faced on both macro and local levels.

In this issue, we’ve summarized information and opinions that address both threats and opportunities ahead. We hope this content will be helpful to you and your team when considering strategy for your hotel and resort portfolio.

TARIFFS AND TRADE DISPUTES—HOW ARE THEY AFFECTING LODGING?

Headlines about tariffs and trade disputes typically conjure images of cargo ships hauling containers or hard goods in and out of ports. But conflicts with trading partners can also affect service industries like lodging and tourism for a number of reasons. Tariffs have negatively impacted the GDPs of major economies. The Organization for Economic Cooperation and Development (OECD) reports that if current tariffs between the United States and China are kept in place, they could shrink the U.S. and Chinese economies by 0.2% to 0.3% by 2021. The group also estimates that U.S. consumer prices could increase by 0.3% in 2020 due to tariffs, decreasing families’ disposable income. Those two effects combined—decreased economic growth and increased prices—double the negative effects of these tariffs.

WEAKENED FUTURE GROWTH – Uncertainty about the implications of current and future trade disputes has already affected business investments domestically and abroad, slowing the average rate of growth to 1.75% this year, compared to 3.5% growth in 2017 and 2018, according to the OECD. Business investments around the world have also decreased, per the OECD, as reported in a recent Wall Street Journal article.

DECREASED BUSINESS TRAVEL – Related to softening business investment globally is international business travel. With less trade between countries, fewer merchants are crossing borders to meet with manufacturers, distributors, and other sources of business. This decrease in international travel directly affects the hotel and resort market in the United States. Similarly, decreased business investments domestically could spell less transient business travel and convention business for U.S. hotels.

STRENGTHENED U.S. DOLLAR – Investors have flocked to the perceived safety of the dollar despite the trade conflicts described above. The U.S. economy remains very strong relative to other nations’ stunted or even negative growth, especially because the Federal Reserve has stayed aggressive with interest rates thus far. Additionally, uncertainty in European economies (namely Brexit) and recession-like environments in many Latin American nations are unnerving capital sources across the globe.

A strong dollar generally makes for decreased inbound international travel and U.S. tourism as it makes it more expensive for foreign travelers to spend money in America. According to the U.S. Travel Association, inbound travel is sensitive to fluctuation in currency exchange rates. A 2016 study from the U.S. Travel Association examined travel by Canadian visitors in particular as that country represents the United States’ largest and most exchange-rate sensitive counterpart. The U.K. is the largest inbound travel market, and the turmoil over Brexit has weakened the pound.

Most recently, Tourism Economics reports that decreases in inbound travel from China are of the greatest concern. The country represents the fifth-largest group of inbound travelers after Canada, Mexico, the United Kingdom, and Japan. Tourism Economics reported a 6% decline in Chinese travelers to the U.S. in 2018, citing the trade dispute between the United States and China as a major contributing factor. In addition to declining business travel between the two countries, slowing economic activity resulted in a sharp drop in discretionary spending by Chinese citizens.

PERCEPTION OF DANGER IN THE U.S. – A final contributing factor in the effect of trade disputes on our industry is the way the U.S. “brand” is perceived by foreign travelers. More and more reports are emerging of negative Chinese attitudes about travel to the U.S. resulting from the Chinese government warnings to its citizens about travel to America. Recent propaganda from China’s Culture and Tourism Ministry alerted its citizens in various travel advisories of gun violence, criminal activity, and other safety concerns in the States. The U.S. Travel Association believes this is in response to the Trump administration increasing tariffs on Chinese goods.

THE SILVER LINING – Despite headwinds in inbound international travel, domestic leisure travel has been a reliable source of demand in markets across the country. The U.S. Travel Association reports that it expects domestic travel to continue to grow as leisure travel continues to expand. Domestic travel is expected to increase by about 2% year-over-year through November, and business travel has also rebounded nicely from negative trends earlier in the year.

CAP RATES, PRICING, AND DEAL VOLUME—HOW ARE THEY TRENDING?

Generally speaking, many of the country’s larger real estate investors seem to have been in a “wait and see” mode over the last year or so when it comes to the lodging sector. Capitalization rates have remained effectively unchanged in the last twelve months despite changes in interest rates. The Federal Reserve increased interest rates nine times between the late 2015 through 2018, and the yield on a 10- year U.S. Treasury has slowly declined in recent months. In addition to the Fed’s policy reversal by cutting the benchmark rate in late July, many are anticipating further protective measures by the Central Bank to insulate the U.S. economy from continued trade tensions and concerns of a looming recession. While we’ve historically seen cap rates fluctuate with changes in interest rates, in this cycle cap rates have just barely moved.

We believe the difference is all in the timing of the changes taking place in the broader market. Real estate investments are not as liquid as other investments such as stocks, so while cap rates do eventually respond to interest rate trends, there can be a lag time of several months. Many anticipate that the Fed will continue to lower its target rate for the balance of the year, which we expect will generate an upswing in deal volume in the last quarter of the year. We anticipate that per-key pricing will also increase as the dry powder that has been sitting on the sidelines waiting for deals to flow will be aggressive in their effort to place capital.

Meanwhile, other changes are afoot from the Fed and global banking governing bodies. It’s not a matter of if, but when the secured overnight financing rate (SOFR) is adopted to replace increasingly unsuitable London Inter-bank Offered Rate (LIBOR). Investors are resistant to the change, or even just apathetic, but it’s only a matter of time before the shift—anticipated sometime in 2021—affects global markets. For now, prudent investors are educating themselves on how these changes in benchmarking interbank borrowing costs will affect entire economies, not to mention their day-to-day investment activity.

OPPORTUNITY ZONES—ALL ABOUT TIMING?

Managing Director C.A. Anderson was recently interviewed by Lodging magazine on the topic of hotel developments in opportunity zones. The following is an abridged version of the article, “Are There Still Opportunities for Hoteliers in Opportunity Zones?” by Christine Killion.

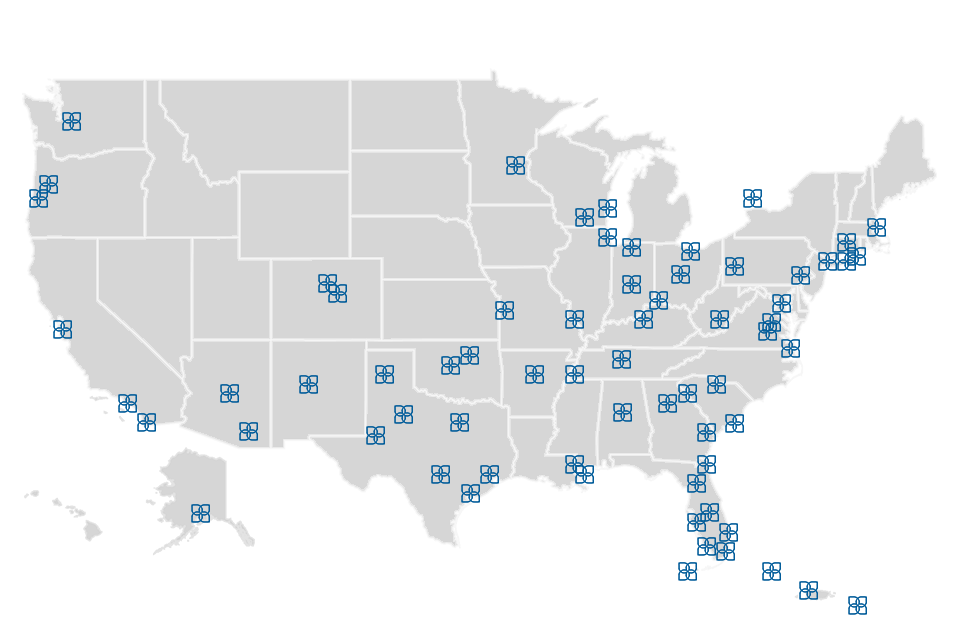

With the Tax Cuts and Jobs Act of 2017 came a new potential avenue for hotel developers and investors to find tax relief: Opportunity Zones. Intended to encourage investment and job creation in struggling areas, these designated localities are defined by the IRS as economically distressed communities where new investments could be eligible for certain tax benefits. The 8,700 Census tracts that qualify span all 50 states, Washington, D.C., and five U.S. territories, and were previously nominated by their respective states and certified by the Treasury Secretary.

Nearly a year after the IRS released its code, many questions surrounding the law remain unanswered, says C.A. Anderson, senior managing director at The Plasencia Group, a national hospitality sales, investment consulting, and advisory firm. Some uncertainties revolve around how the law could change in the near future, particularly in light of a new Congressional makeup. “It puts a lot of questions in the minds of investors asking, ‘What if it gets repealed right in the middle of my investment,’” Anderson explains.

Other unknowns have to do with the law itself. At a basic level, investors can defer tax on prior gains invested in a Qualified Opportunity Fund (QOF) until December 31, 2026. If that investment is held for longer than five or seven years, there is a 10 percent or 15 percent exclusion of the deferred gain, respectively. If that investment is held for 10 years or more, investors can take advantage of an increase in basis of the QOF investment that is equal to its fair market value on the date that the fund investment is sold or exchanged.

“If you invest in 2018, 2019, 2020, you’re probably going to get a majority of the tax benefit,” Anderson explains. However, when hoteliers invest closer to 2026, they will only see a marginal increase. “So, then the question is—is it really worth your time to do that? Because you committed this sizable amount of money or whatever your gain is, and you’ve really stopped it from working for you because now you’re putting it into another fund that has to continue and keep 90 percent of its investments in wherever that fund or business is located.”

The self-administered nature of the program has also given some investors pause. In short, investors proceed with a project in a site that is located in a QOF Census area, and then complete Form 8996 to create a self-certified, QOF business. “Now, if the IRS comes back and they audit you and say, ‘you know what, you’re two blocks off of that,’ or, ‘you built over this,’ then what happens to your investment,” Anderson asks.

Even with these questions, certain types of investors are hedging their bets on the tax advantages offered by Opportunity Zones. Real estate investors looking for a long-term yield and high-net-worth individuals could stand to benefit, for example, compared to private equity and REITs.

In addition to the points presented in this article, we’re finding that many of our clients were already working on development projects in Opportunity Zones when the regulations were released, making for even better returns on those deals. An important point to consider is that those developers were already betting on the prospects of those specific locations. The fundamentals of an investment still need to be sound, and we caution against investors starting new-build projects solely to take advantage of tax incentives.

While the window may be closing to begin a development in an Opportunity Zone to take full advantage of the potential tax benefits, it may be worth examining your existing portfolio and development plans to identify whether additional savings are available to your investments.

WHICH INVESTMENT MARKETS ARE ON THE RISE?

We are often asked by investors to report on trends and movements in the lodging sector that portend good investment opportunities. As we travel the country completing investment activities or consulting engagements, we’ve compiled the list below identifying several areas of growth opportunities in hospitality.

MEDICAL-CENTRIC SUBMARKETS – We continue to see a good amount of growth of medical tourism emanating from domestic and international travelers alike (elective and cosmetic procedures that require recovery), families and extended stays for specialist visits in renowned medical centers and universities. Areas of opportunities include the Texas Medical Center in Houston, UF Health at the University of Florida in Gainesville, the Cooper Clinic in Dallas, and the Duke University Medical Center in Durham.

SOME AIRPORT SUBMARKETS – Areas immediately surrounding several airports across the U.S. present a great opportunity to capture unmet demand. Many of these airports remain undersupplied as their passenger counts continue to rise. They include areas to the west of Phoenix Sky Harbor International Airport (PHX), Love Field (DAL) in Dallas, the about-to-open New Orleans International Airport (MSY), areas to the north of Midway Airport (MDW) in suburban Chicago, and the southern entry to Orlando International Airport (MCO). It is also important to note that many potential airport development sites may be in Opportunity Zones.

FLORIDA’S GULF COAST – Investors are encouraged by what they are seeing along the coastal markets of Florida’s Gulf Coast, from Sarasota south to Naples. These markets have demonstrated incredible resiliency in quickly rebounding from major storms and other natural adversities of recent years. Land pricing in Florida remains reasonable as do construction costs.

FLORIDA’S SPACE COAST – The east coast of Florida has benefited from a marked increase in private and public-private partnership activity related to space travel. A veritable modern-day “Space Race” now seems to be upon the coastal communities of east-central Florida. This growth bodes wells for Cape Canaveral and surrounding markets such as Titusville, Melbourne, New Smyrna Beach, and even Daytona Beach further to the north. We expect the Space Coast to continue to be an attractive venue for hotel development as America and the world continue to explore the next frontier.

WESTERN SUBURBS OF PHILADELPHIA – A number of well-known and historic communities to the west of Center City Philadelphia present a tremendous opportunity for hotel development. Many of these towns and villages, from Merion, to Ardmore and Bryn Mawr, and on to Wayne and Berwyn, are home to dozens of well-known companies, universities, medical facilities and even manufacturers. Yet there is very little hotel inventory to meet the needs of those demand generators. In fact, there is no branded, full-service hotel for the entire length of Route 30 (Lancaster Avenue), from City Avenue in Philadelphia all the way to Paoli.

DESTINATION FEES—NOT JUST FOR TRADITIONAL RESORTS?

The theme of late for our industry seems to be modest profit growth tempered by increasing expenses. While there are a multitude of options to consider when it comes to both decreasing costs and increasing revenue, destination fees continue to be a prevalent method of driving profitability, even at properties not considered traditional resorts. For example, the growing “urban resort” category shows no signs of slowing growth, at least anytime soon. Each major brand seems to be making its mark in this emerging sub-category with marquee luxury projects such as IHG’s Six Senses Resort and Spa in West Chelsea, Manhattan, New York City.

We’ve advised owners and investors on destination fees—also known as resort fees or amenity fees— when it comes to both operations and acquisition underwriting of late. So, what does implementing these “mandatory” fees entail, and what should owners and potential owners know about them? We’ve broken down the facts and figures here.

THE BASICS

Destination fees increased 400% between 2017 and 2018, to $2.93 billion, and are expected to break that record in 2019, according to the U.S. Lodging Fees and Surcharges Forecast by Bjorn Hanson, a clinical professor at the Tisch Center for Hospitality and Tourism at the New York University School of Professional Studies. Destination fees originated in traditional, full-service, branded resorts in order to make charges more transparent to travelers by grouping the expenses a guest is paying for various amenities into a single line item. For example, a traveler might pay a fee of $40 per night to cover the costs of a range of amenities such as shuttle service, Wi-Fi access, newspaper delivery, pool use, fitness center access, and towel service.

Over time, destination fees have been introduced at more upper-upscale and upscale properties, especially in transient-oriented, Top 25 urban markets such as New York, San Francisco, and Washington, D.C.

Many anticipate that these surcharges will increasingly be charged over the next few years across more secondary and tertiary cities as well, and potentially even at select-service hotels.

THE BOTTOM-LINE BOOST

Occupancy is at an all-time high in almost every major market, with average daily rate growing modestly, more or less in line with inflation. While hotel owners and operators contend with increasing fixed costs such as labor, insurance and property taxes, many are looking to increase revenues to offset those expenses to sustain profitability. Destination fees have been the go-to solution.

Such fees typically range from $25 to $40 per night. Because virtually no additional capital is required for many of the existing amenities being offered as a package, almost all of this revenue flows straight to the bottom line.

Further, this improvement to a property’s GOP can make a significant difference for an investor when underwriting a potential acquisition on an internal rate of return basis. In fact, we’ve observed cases in which the introduction of a destination fee has been a significant contributor to a transaction’s feasibility for the purchaser. After all, additional income in the range of $25 to $40, per room, per night, can make a remarkable difference in bottom-line profitability through the duration of the investor’s hold period.

THE BRAND’S INPUT

A franchised hotel owner or management company is typically required to formally propose a destination fee for a given property to the hotel’s parent brand. The brand will then either approve the fee going forward or request changes in the proposal. For example, Marriott International requires that a destination fee offers at least four times the value to the paying traveler, as a package, than what is actually being charged as the fee. In other words, a $25 fee must offer $100 in value, whether it be in the form of on-property food & beverage credits, early check-in availability, or any of the other amenities mentioned earlier. Keep in mind that in many cases an existing property isn’t adding any new amenities; it’s simply assigning values to existing ones and charging for the aggregated bundle.

Some travelers complain that the brands haven’t implemented consistent standards for destination fees across their properties, citing that the bundle of services offered in the surcharge can vary substantially between two otherwise comparable hotels. As these fees become more commonplace, industry experts seem to agree that traveling public will continue to urge the brands to offer similar packages of amenities across their portfolios.

THE POTENTIAL RISK

Some in the industry contend that regulators will continue to clamp down on destination fees before they become substantially more common, and for a few reasons. In fact, the City of Washington, D.C. recently filed suit against hotel giant Marriott in Superior Court of the District of Columbia. Pricing transparency is the root of these potential risks, especially if the traveler is booking through an online travel agency or other third-party where only the daily room rate is listed, but without the additional fees that are typically disclosed when booking directly.

If the Federal Trade Commission (FTC) were to determine that destination fees are illegal in some or all circumstances, this trend could immediately grind to a halt. However, the FTC has previously examined the transparency of destination fees and has subsequently provided guidance to the industry on the topic. In 2012, the FTC articulated that so long as fees are clearly disclosed to the purchaser up front, then there are no indications of deceptive practices.

Beyond regulatory concerns, others are taking into consideration guest loyalty. Some suggest that if a traveler isn’t asking for these services to be bundled, it may stir up distrust, particularly among leisure travelers who aren’t accustomed to paying such fees at properties they may not consider to be full-service resorts. As reported by HVS during a presentation at the NYU Lodging Investment Conference in June, RevPAR growth over the last five years has been driven primarily by leisure travel. These leisure travelers tend to be the most price-sensitive and thus, the most likely to review their folios line by line, questioning fees for bundled services they feel they didn’t utilize or even ask for. Further, travelers are increasingly scrupulous when it comes to pricing transparency at the time of booking. Many savvy, budget-oriented travelers reference resources such as the website ResortFeeChecker.com. This site touts a catalog of more than 2,000 hotels and resorts, listing whether those properties charge their guests destination fees, and if so, how much. The rebuttal to travelers is simple: book directly for the most straightforward breakdown of fees when reserving hotel rooms.

While a traveler revolt or a resulting regulatory crack-down on these partitioned fees isn’t expected anytime soon, owners and investors should stay apprised of changes to industry-wide federal regulations related to pricing transparency so they may react accordingly.

THE LONG AND SHORT OF IT

Even if you haven’t traditionally thought of any of the assets in your portfolio as resorts, adding a destination fee to select properties may be worth considering as one method of improving profitability in the intermediate term. Just be sure to deliver a level of amenities commensurate with the fee being charged. We recommend using prudence and fairness in the implementation of destination fees.

On the Road: Le Pigeon

738 East Burnside Street, Portland, Oregon 97214 | lepigeon.com | (503) 546-8796

This French bistro has been considered one of Portland’s top restaurants for more than a decade. James Beard Award-winning Chef Gabriel Rucker keeps new and exciting dishes rotating into the menu regularly, while continuing to serve up his classic dishes. Reservations are accepted for nightly dinner service at the restaurant’s three communal tables. Seats at

the chef’s counter are available to walk-in guests on a first-come, first-served basis

What to Order: If the lamb shoulder is available, you won’t be disappointed. Pair it with a recommended wine from France or Oregon. The dessert menu is short but the selections are of high quality—save room for a few sweet bites to complete your dining experience.

Suggested by: Nick Plasencia | (813) 445-8276 | nplasencia@tpghotels.com

On the Road is a collection of some of our favorite places we’ve visited as we travel the country. Review more of our recommendations, those from friends of the firm, and submit your own by visiting tpghotels.com/on-the-road.

Introducing Andrew Pappas

The Plasencia Group is pleased to announce that Andrew A. Pappas has joined the team as a Financial Analyst, supporting the firm’s growing client base from its Tampa, Florida headquarters. Mr. Pappas’ primary responsibilities include conducting underwriting analyses and preparing investment offering materials and financial proformas.

Prior to joining the company, Mr. Pappas worked as a Research Analyst with CBRE Group, Inc., one of the largest commercial real estate service companies in the world. During his time with CBRE, Mr. Pappas conducted detailed investment analyses, evaluated market fundamentals, and developed research reports among other efforts to support brokerage teams.

Mr. Pappas is currently completing his final semester of coursework in pursuit of a Master of Professional Studies in Real Estate Finance degree from Georgetown University, and is expected to graduate in December. He earned a Bachelor of Science degree in Finance from the University of South Florida’s Muma College of Business. He is proficient in various real estate analysis tools and methods and obtained the CCIM Financial Modeling for Real Estate Development designation.

Please join us in welcoming Andrew to the team! He may be reached at (813) 445-4842 or apappas@tpghotels.com.

Andrew Pappas

Financial Analyst

Lodging Investment Roadmap Summary

We hope this information presented in this publication has been interesting and helpful to you. Our team is at the ready to address any of your questions and thoughts about the ideas published here and how they relate to your holdings. We would be pleased to speak with you about your portfolio at any point in the cycle, and we truly believe now is a good time for owners to evaluate the options for selling, refinancing, or repositioning their hotel and resort holdings. Please don’t hesitate to contact any member of our team. Until then, enjoy the rest of your summer. We look forward to speaking with you soon!