Posted February 9, 2021

The lodging investment landscape ahead

We at The Plasencia Group anticipate more full-service trades in 2021, especially compared to 2020, though we don’t expect a huge rash of distressed hotel and resort sales early in the year. If you’re an owner, even an unwilling owner such as a bank or other lender, there may be hesitancy to sell now when there is finally a light at the end of the tunnel. We’re finding that some owners unfortunately no longer have the luxury of time, but many may be inclined to wait until there is a demonstrable trend in positive net operating income that would translate to a healthier debt market and higher valuations.

Now that COVID-19 vaccines are being distributed and air travel is expected to gradually increase each month, hotels should also begin to return to some sense of normalcy by mid-year. As in past cycles, the availability of debt is the big cog at the center of the hotel transaction wheel that will drive all other activity. Lenders are still remarkably cautious, and the prevailing sentiment in the lending community is that they need to witness an upward trend in operating fundamentals before they fully open the spigots. Hotel cash flow and transaction activity should improve virtually at the same pace that needles are jabbing arms.

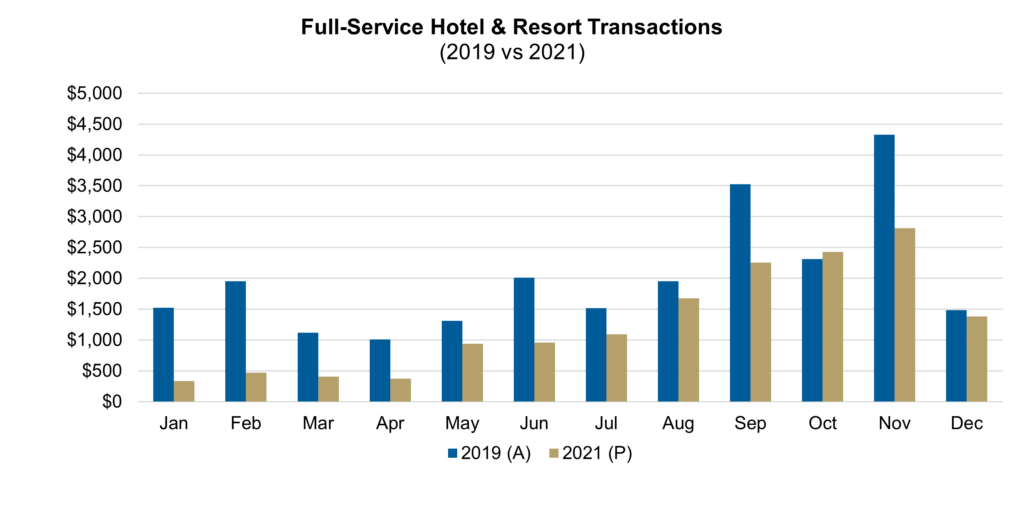

We do not expect deal volume will get back to 2019 levels ($24 billion) for several more months, but the pent-up need to place capital should nevertheless spur activity in the second half of 2021. The increase in foreclosures, demands by fund investors for a return of their capital, and the desire by lenders, major funds and PE firms to deploy capital, will all serve to fuel more full-service transactions at a faster pace. Against this backdrop, we don’t expect the big slug of full-service hotels and resorts, including several portfolios, to hit the market until bottom lines improve later in 2021. Only when owners can demonstrate trends confirming that their hotels are back on a course to profitability will we see a marked change in deal volume and pricing. That said, the growing amount of capital seeking deals right this minute is unprecedented, so we expect full-service hotel deal volume to approach or exceed $15 billion in 2021, but only if the pace of trades accelerates in the second half of the year.

Source: Real Capital Analytics for 2019 Full Service Transactions; The Plasencia Group

In light of the number of exasperated buyers in the market today, if you’re an owner, here’s something to consider: While many other others may be waiting until bottom lines improve, you may want to act now to “beat the crowd.” This allows you to take advantage of the dearth of quality assets on the market and the overabundance of realistic capital eager to invest. Deals are getting done. In fact, we have completed over $200-million worth of hotel transactions in the past 90 days or so! We have found that pricing for quality assets with substantial leisure demand that have weathered the pandemic are relatively financeable in today’s environment. Valuations are proving to be resilient for many leisure-oriented properties. In the last downturn, sellers who went to market early fared better with pricing than those who rode with the pack. You may want to consider going to market now with your hotel. If pricing isn’t where you need it to be, there’s always tomorrow. We’re here to help and happy to discuss at your convenience.