June 27, 2024

Download a PDF version of Market Insights – Charting Course: Diving Into Hotel Investments in the Florida Keys

Captivating sunsets, world-class sportfishing, and laid-back beach bars draw throngs of visitors to the Florida Keys each year. During the height of the COVID-19 pandemic, the Keys encapsulated an entire nation’s deepest travel desires: after Highway 1 was literally closed to outsiders in April and May 2020, it was immediately inundated by tourists combatting cabin fever upon its reopening.

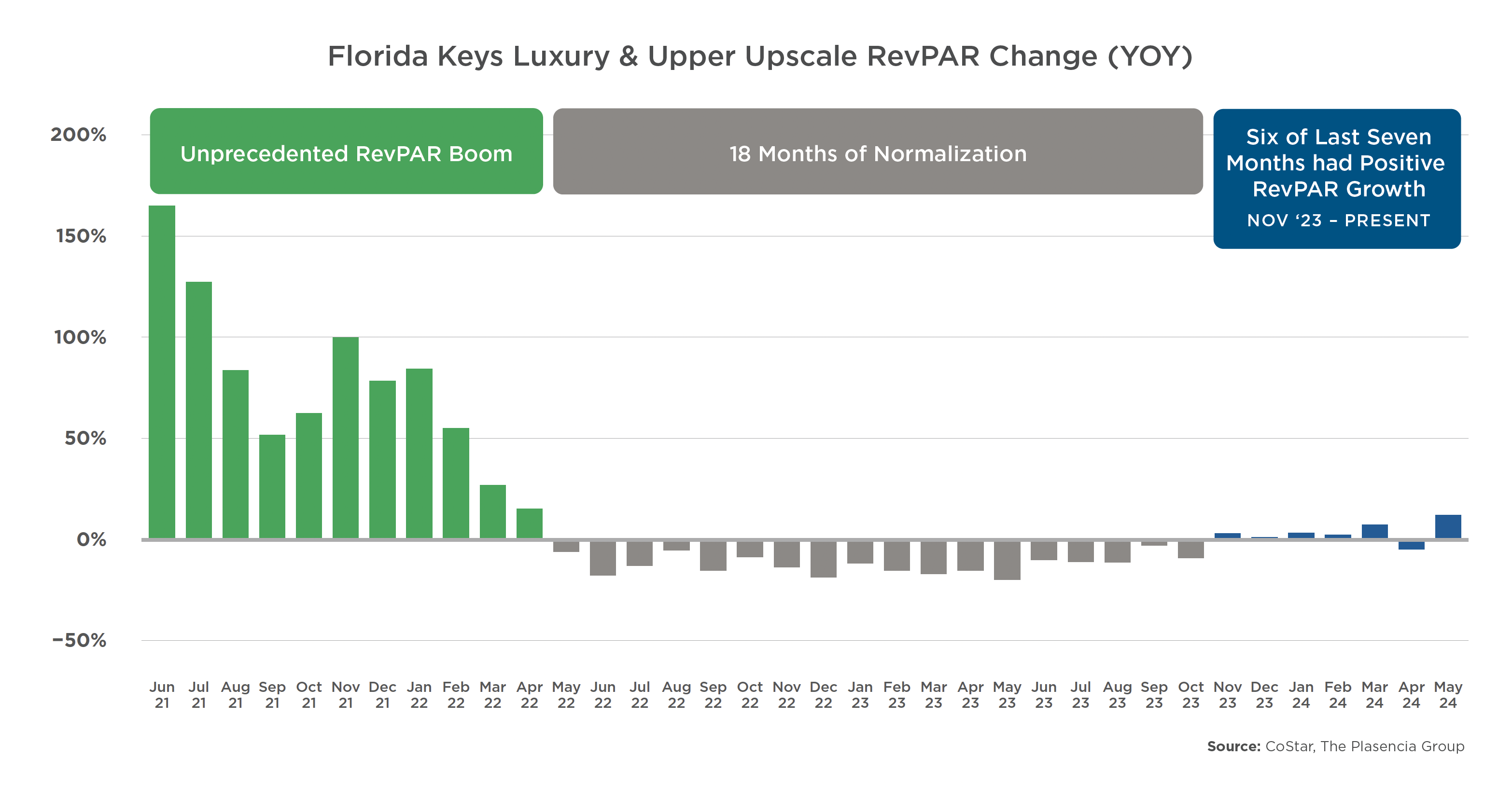

By the peak spring season of 2022, guestroom demand for Luxury and Upper Upscale hotel product in the Keys had surged 10% above pre-pandemic figures. With more cash in those visitors’ pockets, hotel RevPAR for high-end properties during the twelve months ended April 2022 outpaced 2019 metrics by an astonishing 69%.

Alas, the reopening of Europe and the Caribbean, the cruise industry, and major domestic urban tourist destinations during the summer of 2022 curbed the Florida Keys’ meteoric rise, and the market entered a painful era of normalization, enduring eighteen consecutive months of year-over-year RevPAR declines from May 2022 to October 2023.

The Calm Before the Storm

Transaction activity in the Florida Keys closely mirrored the operational trends. Zero Luxury and Upper Upscale hotels and resorts transacted in the Florida Keys in 2019 and 2020, followed by the transaction markets exploding in 2021 and 2022, with more than $660 million in high-end properties trading hands throughout the Keys. However, the confluence of the RevPAR downturn and skyrocketing property insurance costs subdued transaction markets, and no Luxury and Upper Upscale transactions have been recorded in the Keys since 2022.

Smooth Sailing

Amidst these turbulent waters, a sense of equilibrium has emerged, and hotel and resort owners in the Keys find themselves on their most level footing in years. Following the year-and-a-half stretch of reeling RevPAR, Luxury and Upper Upscale properties in the Keys have enjoyed RevPAR growth in six of the seven months from November 2023 to May 2024, including an encouraging 12% pop in May. Luxury and Upper Upscale trailing-twelve-month RevPAR in the Florida Keys in May remains 42% higher than 2019, representing an astounding 8.2% CAGR.

Moreover, the shocking increases in property insurance of 2022 and 2023 have come into balance, with most owners anticipating only slight increases, or potentially decreases, to their premiums in 2024.

Crucially, only a single hotel is under construction in the Keys, the 110-key, Bass-Pro-Shops-affiliated Valhalla Island Resort near Marathon. This dearth of new supply provides ample runway for operational success throughout the Keys.

Market Stability and Lack of New Supply Portend Renewed Desirability

With property performance, insurance, and the debt markets all stable, and against the backdrop of virtually zero new supply, The Plasencia Group expects hotels and resorts in the Florida Keys to once again reattain their position at the top of every hotel investor’s wish list.

If you’re contemplating a disposition or looking to acquire a property in the Florida Keys, let The Plasencia Group team leverage our over thirty-one years of market expertise and Florida know-how.

We invite you to get in touch with one of our Investment Sales team members today to discuss how we can help you achieve your investment objectives.

Over Thirty Years of Client Success

It would be our pleasure to assist you in the evaluation, acquisition, sale, or financing of your properties in the Keys, the State of Florida, and across the country.

In addition to our investment advisory practice, our firm also provides ownership representation services and development and renovation consulting expertise to hotel and resort owners. If we may be of assistance with any detail of your hotel, resort, or property portfolio investment, please call us directly at (813) 932-1234 to start the discussion.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.