April 10, 2024

Download a PDF version of Market Insights – Downtown Austin: RevPar Recovery Is In the Works

Austin remains one of the most sought-after investment destinations in the country

Since the onset of the pandemic, Austin, Texas, has been a darling market across all real estate asset classes, and in particular, the hospitality industry. Innumerable companies moved to or expanded their presence in the city, and teems of new residents now call Austin home. Real estate investors of all types rushed to enter the market in the immediate wake of the Covid-19 pandemic, and it remains one of the most sought-after investment destinations in the country based on our recent discussions with active hotel buyers.

Recovering from the Pandemic / New Supply “Double-Whammy”

Our conversations regarding Austin have taken a slightly different turn of late, as RevPAR growth, particularly in the CBD, has been lackluster recently. When looking at the CBD’s February 2024 TTM RevPAR ($173.47), it is somewhat surprising to see that it is actually lower than the CBD’s February 2020 TTM RevPAR ($177.97), just before the pandemic.

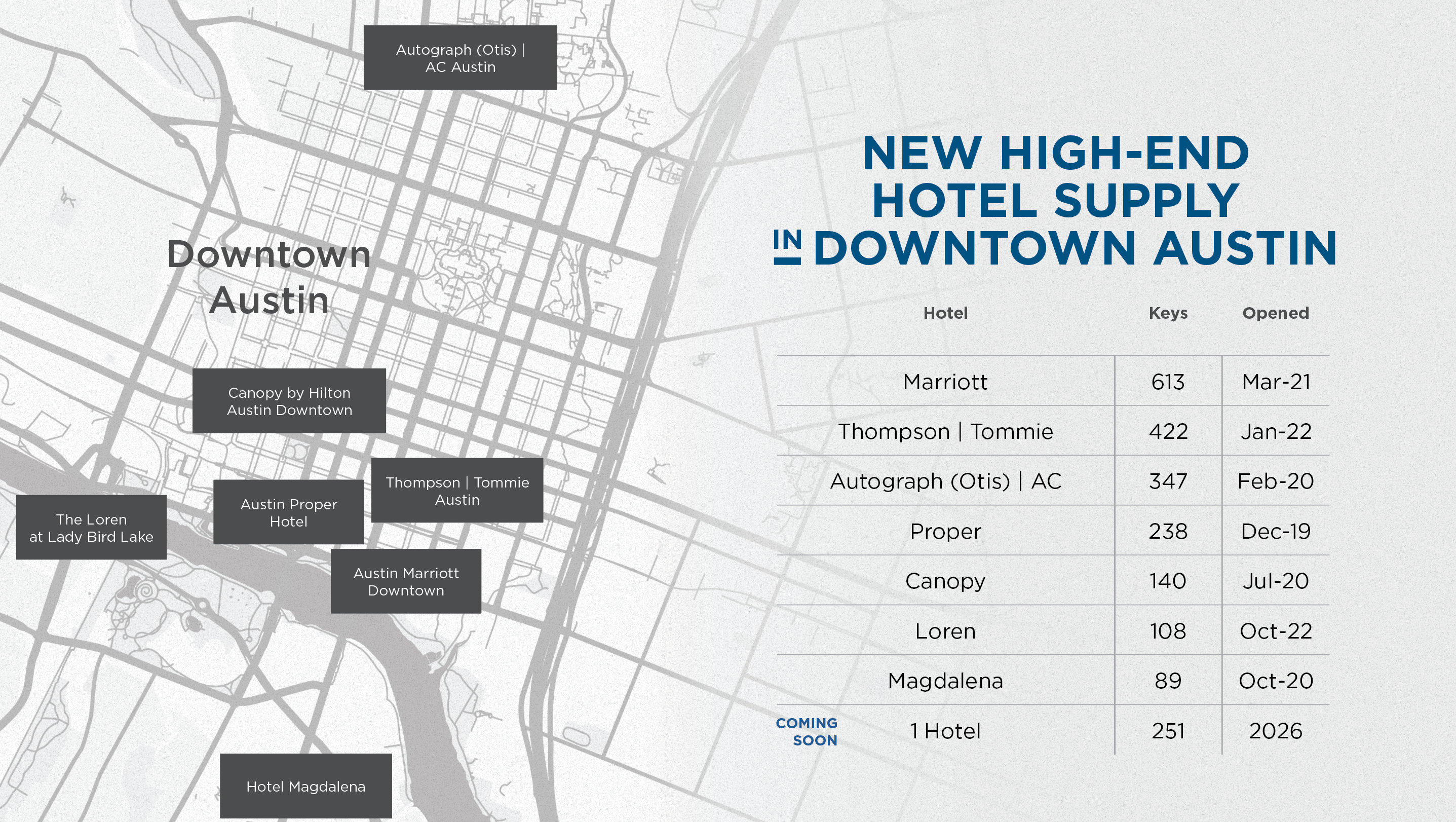

The most glaring reason for this apparent sluggishness is the wave of new supply that was delivered simultaneously with the onset of the Covid-19 pandemic. This “double whammy” had a meaningful negative effect on the performance of existing hotels, flooding the market with new supply in a time when demand was globally crippled. That said, since then, demand has more than recovered to pre-pandemic levels, and now the absorption of new supply is in full swing.

High-end New Supply Lifts ADR Ceiling

Promisingly, the CBD’s TTM ADR has increased by $27 from February 2020 to February 2024. Average daily rates across Downtown Austin should only continue to grow as recently added hotels, especially the newer high-end properties listed above, continue to establish themselves.

The CBD’s ADR will be further advanced when the pending 1 Hotel is delivered in 2026. It is one of the only projects that remains in Austin’s hotel development pipeline, and it will be the tallest tower in Texas once it opens. Other pending hospitality projects in the CBD are select-service hotels that should be absorbed quickly.

New Convention Center Means Short-term Pain, Long-term Gain

One additional hurdle for the Downtown hotel submarket in the immediate future is the $1.6 billion redevelopment of the Austin Convention Center. The project will involve demolishing and rebuilding the Convention Center – a process that will take several years. This will certainly have a meaningful detrimental effect on group business in the city over this period, as the Convention Center will be completely offline. However, when the new, larger, state-of-the-art Convention Center opens in 2028/2029, the city will be at the top of every meeting planner’s list. Long term, this is a massive positive for the local hotel market.

Downtown Austin Remains Appealing Investment Destination

All told, while there have been some hurdles in the recent past and there may be more in the near future, we continue to view Downtown Austin as one of the most attractive hotel submarkets in the country for long-term investment. The pending expansion and redevelopment of the convention center is arguably the biggest reason for long-term confidence.

Read More…

Check out our past reports on the market to see other reasons to be optimistic about Austin!

Over Thirty Years of Client Success

Our investment sales team has completed well over 100 successful transactions and financings in Texas. It would be our pleasure to assist you in the evaluation, acquisition, sale, or financing of your properties in the Texas area and across the country.

In addition to our investment advisory practice, our firm also provides ownership representation services and development and renovation consulting expertise to hotel and resort owners. If we may be of assistance with any detail of your hotel, resort, or property portfolio investment, please call us directly at (813) 932-1234 to start the discussion.

For more valuable hospitality industry news and market analysis from The Plasencia Group, be sure to opt-in to our news and communications list.