Examining Opportunities in Medical Submarkets

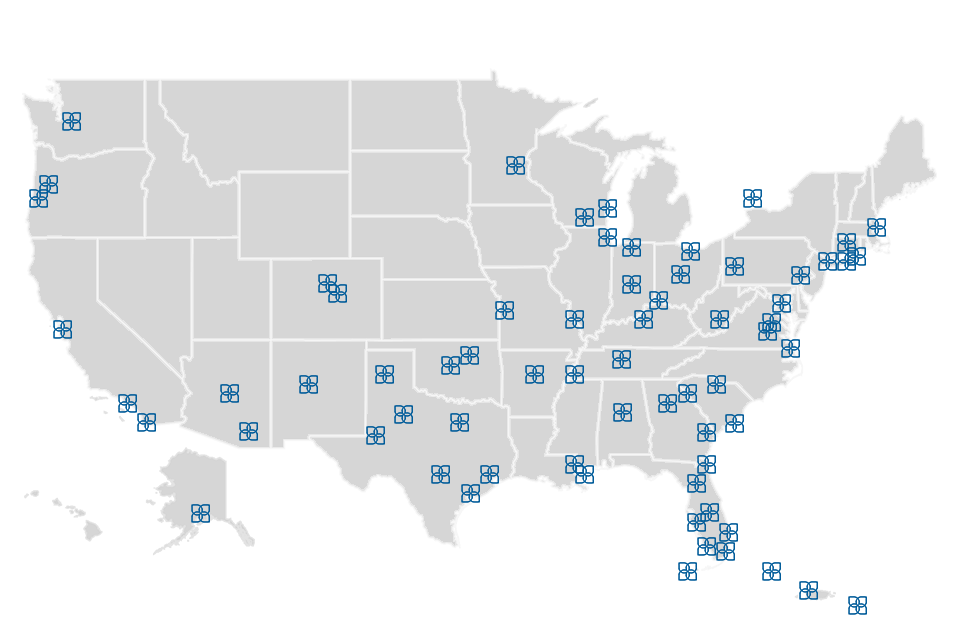

Medical tourism is a large and growing portion of the overall travel market, and some key markets with large medical facilities could be worth a look from hoteliers.

While most of us travel for business or pleasure, sometimes we are forced to travel for medical reasons.

The global medical tourism industry is booming, with as much as $72 billion spent on medical-related travel in 2018. The segment is expected to increase by 25% each year for the foreseeable future. By 2025, the global medical tourism industry is expected to be valued in excess of $160 billion. With cities across the world already actively attracting this demand segment, there are many opportunities for hotel developers to take advantage of this trend, especially in venues with well-known medical centers lining their path.

In most cases, medical tourism largely involves travel to another city or country in order to make use of specialized healthcare professionals or facilities. These travelers are often seeking elective or cosmetic procedures that require a long recovery time. Medical tourism also includes visits by a patient and family members to see specialists at renowned medical centers and universities, or extended stays for medical research studies.

Medical tourism is intrinsically linked to the hospitality industry. Quality of care is an ongoing concern for all patients, and the hotel experience of the traveling patient or a family member has the ability to both positively and negatively impact a patient’s recovery. Hoteliers are keenly aware of this and are taking special measures at their properties to improve the experience of the patient “guest” and that of his or her accompanying family.

In many communities surrounding hospitals and medical centers, patients and families have had to resort to renting apartments or using services such as Airbnb and VRBO for their long-term stays. Hotel owners and developers have been working overtime through this cycle to build new and unique lodging facilities or to update or replace aging properties to accommodate the special needs of guests with health issues. Furthermore, rapid growth in the world’s elderly population and the associated need for skilled medical specialists has now hit critical mass, further adding to the growth of medical tourism. As such, properties are also being designed to accommodate an aging population and their loved ones.

Below are examples of three U.S. markets that are quickly adapting to increased medical travel:

Durham, North Carolina

Durham, North Carolina, is home to busy medical facilities such as the North Carolina Specialty Hospital and Duke University Medical Center, along with nearby associated universities. The demand generated by these institutions is met with a relative lack of hotel supply, especially considering Duke University Medical Center alone has 938 licensed beds and often operates at full capacity. This has not gone unnoticed by hotel developers. There are currently two hotels under development in the area, scheduled to open in Q3 and Q4 of 2020, respectively. A third hotel complex, the 220-room Hampton Inn/Home2 Suites Durham, is expected to open in Q2 2021.

Houston, Texas

The sprawling Texas Medical Center (TMC) in Houston is the largest medical district in the world. TMC is home to more than 9,200 patient beds, and receives an estimated 3,300 patient visits per day. The area is currently supported by a fair number of full-service hotels in the immediate area and a sprinkling of other hotels in the surrounding area. A 354-key InterContinental hotel recently opened in the heart of TMC and a 273-key Westin is currently under construction in the district. Even with these developments, the room count in the area is still relatively low considering the unbridled demand generated by the sprawling medical complex. Unlike other areas of Houston and Texas, developable real estate is increasingly difficult to find in the immediate area of TMC, making existing hotel assets all the more valuable. The TMC hotel submarket also benefits from proximity to Rice University and the University of Houston, NRG Park (home of the Houston Texans NFL team and the Houston Livestock Show and Rodeo), and the high-end Museum District and University Place areas.

Weston, Florida

The Cleveland Clinic has a major presence in South Florida, headlined by its massive Cleveland Clinic Florida campus in Weston, just outside of Fort Lauderdale. The Weston facility recently completed an expansion that included the addition of a new 221,000-square foot multi-level hospital tower. The top-ranked hospital in South Florida, Cleveland Clinic Florida’s occupancy typically exceeds 90%. Only three major-branded hotels are in the general area of this rapidly expanding healthcare facility, and just one property, a Cambria, is in development nearby. As the campus continues to grow and associated demand increases, the need for easily accessible hotel rooms will become more apparent.

As stated earlier, medical tourism sometimes involves travel to other countries. While the U.S. boasts some of the highest healthcare costs among developed nations, it is still one of the top 10 global destinations for medical tourism. High medical costs in the U.S. have led to the formation of several cottage industries centered around affordable cross-border healthcare in Canada and Mexico. This is the case with the Mexican town of Vicente Guerrero, situated on the U.S.-Mexico border near Baja, California. Today, Vicente Guerrero has a bustling economy thanks to the more than 350 dentists who have set up shop there. Restaurants, bars, and shops have sprouted up to support people who are in town for a root canal or new crown. Professional, branded hotel accommodations are a logical next step in the evolution of this market. For some travelers, the cost of a medical procedure just across the border can be far less expensive than the same procedure in the U.S., even including travel and lodging costs.

Medical tourism is expected to grow across the globe in the coming decades, and hotel companies are just beginning to tap into the potential of this potentially huge demand generator. The rise of specialized hotels and the continued success of the extended-stay segment are both positive trends for development in medical markets. It will take a keen eye, but owners and developers who find their way into these markets early will be well-positioned for financial success and long-term resiliency.

This article appeared in Hotel News Now on December 10, 2019.