Fall 2017 Lodging Investment Roadmap

Posted November 13, 2017

To our clients and industry friends:

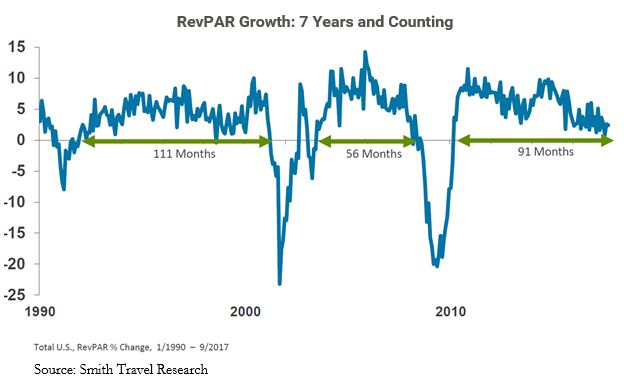

We, like many of our clients and peers, continue to speculate on just how much longer this positive cycle might last. Many hotel and resort owners and operators continue to enjoy an unprecedented period of continuous RevPAR growth—mostly attributed to rate—despite substantial new supply in some markets. Increasing expenses and other factors may threaten bottom-line returns, but the general consensus is that we will continue to experience a stable economy through the balance of 2017 and beginning of 2018 that will extend support to lodging performance and transaction activity.

In this issue of the Lodging Investment Roadmap, we share anecdotal information and insight we have gathered from clients and peers over the last several months. If there are topics you’d like to see addressed in a future issue, please drop us a line!

What does a less optimistic outlook for RevPAR growth mean for the months ahead?

Smith Travel Research continues to report virtually monthly on the industry’s almost unprecedented and uninterrupted period of RevPAR growth in the United States. Through September, the industry had experienced 91 months of positive RevPAR growth, a pace that now dates to 2010 and extends the lodging sector’s longest and strongest recovery since 1987. Despite a moderate outlook of 2.0% to 2.5% GDP growth ahead, owners, managers and investors remain somewhat cautious about future growth. Many are considering the potential for much slower EBITDA growth over the quarters ahead, especially if expenses continue to outpace revenue growth. As labor, insurance, property taxes and other operating costs continue to grow, profit margins have become much thinner.

How is the lodging sector reacting to the overall business environment?

The hospitality arena has certainly benefitted from a variety of factors leading to continued RevPAR growth. The U.S. economy continues to deliver relatively strong performance which, from all apparent signs at the hotels we asset-manage, leads us to believe the next 12 to 18 months will be more of the same. The nation’s economic growth has been fueled by strong residential housing investment as well as spending on manufacturing equipment and research.

Investment by U.S. companies has increased, especially in the past 24 months, returning to levels consistent with previous economic cycle peaks in 2001 and 2007. As an example, spending on new equipment is now more than 20% higher than at its previous peak during the first quarter of 2007, before the last economic expansion ended. Many economists we follow believe that this investment surge by businesses is what the domestic economy has needed to deliver consistent growth. The lodging sector has certainly benefited from this key variable.

One other factor which could be a boon to the U.S. commercial sector is the current tax reform effort going through Congress. A tax-free repatriation of profits long-held in foreign countries would likely mean increased spending in domestic manufacturing and R&D. Further, lower corporate taxes could spur higher paid wages and economic expansion. For now, barring a global or national catastrophic event, we are hopeful that hotels might actually experience an increase in profits during the next 24 months, in all likelihood at the same, temperate pace.

What does the general hotel investment landscape look like at this stage of the cycle?

A recent inquiry of members of the Hotel Development Council (HDC) of the Urban Land Institute reveals that most investors remain confident if not bullish about lodging investments. The HDC’s members include major REITs, private equity firms and other traditional hotel investors. An unscientific survey of members indicates that the majority of respondents believe that there are anywhere from one to two years of growth remaining in the current cycle. Over 40% of the polled members are currently net buyers, while the same number are net sellers. Clearly, operating fundamentals continue to provide a good degree of confidence among the better-known owners of lodging properties in the U.S. Absent a seismic event of national or global proportions, we expect to see, for the next 24 to 36 months, much of the same stable investment environment that has prevailed for the past several years.

What are REITs doing at this stage of the cycle?

Public lodging REITs have taken the cautious approach at this late stage of the economic cycle, both with their purchases as well as with dispositions. In general, however, most REITs have been methodically pushing their lower performing or non-core holdings out the door. At the same time, companies such as Summit, Sunstone, RLJ and Ashford are moving to enhance the quality of the assets entering their portfolios. REITs have been much more aggressive in their efforts to rid themselves of their lower performers, move into better-performing markets or submarkets, or pick up higher-end hotels that are accretive to their overall portfolio RevPAR.

With respect to REIT investment activity, we expect, based on conversations with numerous C-Suite residents, that there will be increased acquisition activity over the next six to twelve months. That supposes, of course, that the product will be available for them to acquire. The cost and availability of capital for public companies, as well as their cash positions, make it difficult to not take advantage of the situation. Notwithstanding an increased level of investment activity by REITs, we do not expect the volume of public company purchases to approach previous peak acquisition levels simply due to the lack of available product and the absence of M&A and large portfolio activity.

While some REITs have heretofore been unwilling to acquire assets from their publicly-listed brethren, that impediment is becoming much less of an issue to many companies, especially if such acquisitions present an opportunity to improve portfolio make-up and shareholder returns. This is especially the case when the selling REIT is disposing of an asset not because of poor performance, but because it is over-weighted in a particular market or region. Additionally, brand-managed hotels, which are less attractive to private equity and third-party managers, present an excellent target for many public companies given the diminished competition.

How will rising interest rates affect lodging investments?

When discussing the lodging investment environment with clients and peers, we generally ascribe fluctuations throughout any cycle mainly to “the two ‘in-s’”: inventory and interest rates. While a myriad of other factors affects individual geographic markets, these two factors make up the lion’s share of influence when it comes to the variables that matter most to those making decisions on commercial real estate investments. This is especially so when it comes to buying, selling, holding or refinancing hotels and resorts.

We already know that increased inventory has had a marked impact on performance and values in specific markets such as New York City, Chicago, Miami and Houston. These cities have experienced a disproportionate increase in new supply as compared to national averages. In some areas, decreasing demand makes for a double-whammy. The impact of the other part of the equation, interest rates, has been much more nuanced. Recent interest rate hikes after an extended period of low, short-term interest rates, are usually a very relevant factor in analyzing the near-term future of commercial real estate investments of all classes. Yet, in this latest economic cycle, the influence of rate increases has been much less felt than in past cycles. We anticipate that increases in interest rates will become a more significant issue in the next 24 months.

Cap rates, which have a high correlation to interest rates, have been slowly increasing since the Federal Reserve Bank began its rate hikes. While the Fed recently stated that it will slow its rate bumps, we believe this “relief” will be short-lived.

The Good:

- The Fed’s practice of raising interest rates for the past 18 months clearly signaled to consumers and the business community a confidence in an overall strengthening economy. A growing, inflationary economy typically makes for higher RevPAR and, ultimately, higher valuations. Service businesses, such as hospitality, have historically been very resilient during periods of lower economic volatility.

- Similarly, cash flow investors have been more interested in the income growth that has outpaced rising interest rates, mitigating the impact of rising cap rates on property values.

- The low cost of capital continues to inure to the benefit of hotel investors. Debt capital continues to be plentiful for the time being. When a buyer can acquire a hotel generating strong IRRs while using someone else’s money and paying that capital source a return of under 5%, that proposition is hard to pass up.

The Bad:

- Capital continues to flow relatively freely into the lodging sector, especially from foreign investors seeking the security of the U.S. rule of law. However, lenders have increased loan-to-value ratios, especially in riskier markets. The tightening of underwriting has also tamped down investment returns, and sources of debt have begun to require borrowers to put up a greater proportion of equity up front. Construction financing is also becoming even scarcer.

- We anticipate that the long period of low interest rates will be a thing of the past by 2019. In fact, as we look at macroeconomic data, it seems inevitable that borrowers will be paying higher interest rates, by as much as 100 to 150 basis points, within the next 24 months.

The Opportunity:

- For value-add investors, increasing valuations and the prospect of rising interest rates may accelerate the decision to sell assets, especially as more and more capital seeks deals.

- Borrowers may feel a sense of urgency to borrow now at lower, fixed rates in anticipation of inevitably higher rates in the future.

As interest rates increase, returns and property values will suffer. There has been a dearth of buying opportunities as investors have reaped strong cash flows and fees. Based on conversations with REITs, private equity firms and individual investors, we anticipate more and more assets will come to market in 2018.

How can buyers and sellers best prepare for a transaction in a new era of PIPs?

A hotel’s brand-mandated Property Improvement Plan (“PIP”) is one of the most crucial documents in a hotel or resort transaction. A PIP lays out a renovation scope and timeframe that a new hotel buyer must implement following a change of ownership. In recent years, PIP expenditures have increased profoundly, rendering an outsized impact on the sale proceeds collected by sellers. With the industry enjoying over 91 consecutive months of RevPAR growth through September 2017, most brands have become more aggressive in their PIP renovation requirements, asking for more capital to be spent while the industry benefits from this profitable period in the economic cycle.

The ongoing proliferation of brand options has also contributed to rising PIP costs, as parent brands seek to differentiate consumer experiences at each of their sub-brands, partially through furniture packages, revamped amenities, and finishes. In certain instances, brands may also use PIPs to incentivize changes in sub-brands in markets where they may want to pave the way for the development of a new property under an existing flag, or downgrade or upgrade an existing hotel to a different chain scale within their brand umbrella. By tweaking the requirements and corresponding cost of PIPs with multiple sub-brand options, brands can largely dictate the positioning direction a new owner may be forced to take.

As sellers and buyers navigate a transaction and associated PIP, it is helpful to consider the following factors:

- Evaluate brand options: Sellers and buyers alike should always evaluate brand options during a change of ownership. If the existing franchise agreement is nearing its expiration, would an affiliation with a different brand allow the property to capture additional market share or increase its ADR? If the franchise is locked into place with the current brand, would the parent brand be willing to re-flag to a different sub-brand within their system, potentially providing additional revenue opportunities or operating efficiencies for the hotel?

- Plan for a realistic timeline: It takes time to get a PIP review in hand from virtually all the major brands. Usually, three to six weeks are required to prepare a PIP document that generally remains valid for six to twelve months. We encourage sellers to order PIPs as early in the sale process as possible, preferably before an asset even hits the market. Having the PIP document in hand prior to going to market helps sellers understand the capital expenditures that investors will be underwriting – critical information for estimating eventual sale proceeds when deciding whether to market a property. Once a hotel is listed for sale, sharing the PIP as early as possible allows a seller to convey cohesive and transparent information to the market, bolstering the effectiveness of the disposition process.

- PIPs are negotiable: Like most elements of a transaction, PIPs are negotiable to a certain extent. Brands are typically receptive to sellers and buyers who have existing relationships with the brand and own or manage other franchised properties. Both the scope and completion timeframe of a PIP are often negotiable. Is it possible to push back the bathroom renovation an additional twelve months? Would the brand consider removing certain elements of a PIP, taking into consideration all the other capital being spent at this property and other franchised hotels? Is there another property with the same flag that recently transacted but was not subjected to such an extreme PIP? We recommend that sellers negotiate as much as they can up front before sharing the PIP with potential investors, and also encourage buyers to take another bite at the apple with the brand once they have been awarded a property.

- Return on Investment: PIP renovations often create a path to increased profitability, providing a favorable return on investment. In most cases, new guestroom and public area furnishings allow a hotel to be more competitive both for transient and group demand. Investors will oftentimes underwrite both ADR and occupancy increases following a renovation, with the expectation that the property will increase its market penetration versus its competitive set. However, sellers and buyers alike need to be wary of situations where property efficiency and revenue potential is already maxed out prior to a renovation. In these situations, there may be very little financial justification for pouring additional capital into a property, and investors may opt to deduct estimated PIP costs from their purchase price on a dollar-for-dollar basis without allocating any ROI to their expenditure.

- Capital expenditures in excess of the PIP: Change-of-ownership PIPs typically revolve around guest-facing furniture and finishes in guestrooms, corridors, lobbies, meeting rooms, and other public areas. The PIP document, however, only paints a partial picture of the capital needs at a property. Oftentimes, items outside the scope of a PIP, including ROI projects, elevator modernizations, roof replacements, kitchen equipment upgrades, and maintenance to mechanical systems like chillers and boilers can cost investors (and by derivative, sellers) more than the PIP.

- Ask for capital expenditure estimates: Capital expenditures tend to be one of the largest variables in a transaction. For buyers, this means needing to understand sellers’ estimates of capital needs and how those figures factor into overall pricing guidance throughout a disposition process. We also encourage sellers to request estimates of PIP and other capital expenditures from prospective buyers as part of their Letters of Intent. This measure allows sellers to compare “all-in” valuations between investors on an apples-to-apples basis, and minimizing the potential for unexpected roadblocks or purchase price reductions during the due diligence period of a transaction.

As brand options multiply, PIPs continue to take center stage in many disposition processes. Planning for, scrutinizing, and negotiating PIPs early on can directly increase proceeds to sellers and lower the costs for buyers in most hotel transactions.

On the Road: Costeaux French Bakery & Café

417 Healdsburg Avenue, Healdsburg, California 95448 | costeaux.com | (707) 433-1913

This place has been around since 1923 for a reason. Their bread, especially the sourdough, is killer! Costeaux is located in downtown Healdsburg, two blocks from the town’s idyllic main square with its many shops and restaurants.

What to Order: For breakfast, go for the Costeaux Omelette, made with applewood smoked bacon, spinach, sun-dried tomato, brie and a side of country potatoes. If you really want to lay on the calories, try the Croque-Madame on brioche then stacked with black forest ham, Gruyère cheese, free-range eggs and béchamel.

This new feature of the Lodging Investment Roadmap highlights some of our favorite places across the country, including eateries of all kinds, services and attractions.

We invite you to visit tpghotels.com/on-the-road for more recommendations posted weekly, or to submit a spot of your own!

Lodging Investment Roadmap Summary

As you look ahead and evaluate the performance of your lodging investments, you may find that it may be a better time than ever to consider a disposition or refinancing of a single property or portfolio. Foreign and domestic capital continues to flow into the U.S, eager to bid competitively on quality assets in virtually every major U.S. market.

As always, we welcome the opportunity to discuss your thoughts and questions on lodging investments at any time. On behalf of the entire team at The Plasencia Group, we wish you a joyous holiday season ahead!