Posted February 25, 2021

Owners may be pleasantly surprised to find buyers willing to pay pre-pandemic prices

Overview

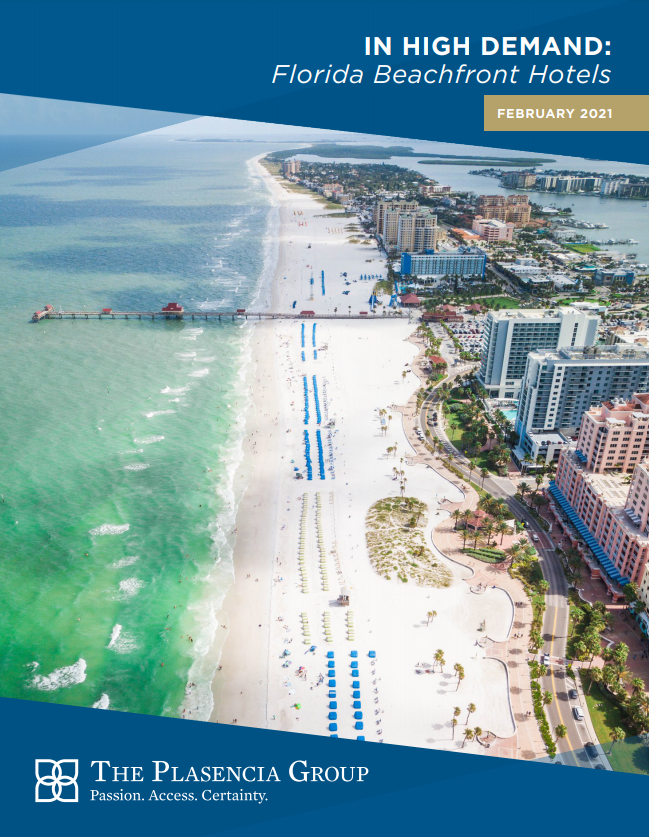

The challenges impacting hotel values due to the COVID-19 pandemic are not as dire for most beachfront properties as they have been for urban hotels. Given the resilient leisure demand, accelerated demographic trends, and renewed investor interest in Florida, owners of beachfront hotels and resorts across the state should not expect to suffer large discounts to value in 2021. In fact, we at The Plasencia Group would suggest just the opposite: in a lodging universe plagued by negative cash flow, mothballed ballrooms, and murky visibility, Florida’s leisure-oriented properties are one of a few shining beacons for the industry and have quickly become a scarce commodity. This is not lost on a real estate investment community flush with cash, but short on opportunities to deploy it. Today, owners of Florida beachfront hotels and resorts may be pleasantly surprised to find a long line of suitors looking to pay pre-pandemic prices (or better) for quality beachfront properties.

Prior to the Covid-19 pandemic, many owners of Florida beachfront hotels had circled 2020 or 2021 for a potential exit of their properties. The state set its ninth consecutive visitation record in 2019, welcoming more than 131 million travelers. RevPAR was hovering near all-time highs, and the tailwinds of economic growth, increased airlift statewide, and favorable population trends had created a unique confluence of record profitability and record-low cap rates. These factors combined to produce all-time-high property values.

The COVID-19 pandemic has obviously upended the global hospitality marketplace, both in terms of real estate operating performance and asset valuations. Ongoing operational challenges, coupled with anemic debt markets, have caused most domestic transactions in the last twelve months to occur at significant discounts to pre-pandemic values, or postponed altogether.

Current Valuation Landscape

Three primary challenges impacting the value of most hotels and resorts:

- Poor temporary financial performance and cash flow shortfalls

- A lack of clarity on the timeframe for an eventual operational recovery, particularly in the group and corporate transient segments

- A slowly recovering debt market that makes reasonable seller pricing expectations tougher to pencil.

Fortunately, Florida’s beachfront hotels and resorts are well-situated to overcome these obstacles.

Mitigated Covid-19 Losses

Florida beachfront hotels have not been immune to the impact of the virus. Stay-at-home orders during the 2020 peak tourist season in March meted out pain indiscriminately, and travel restrictions persisting around the country are still preventing hotels from maximizing occupancy. However, during the second half of 2020 and into the first quarter of 2021, beachfront hotels and resorts have capitalized on their outdoor attributes to capture an outsized portion of drive-to, leisure-transient demand, resulting in occupancy levels higher than virtually anywhere else in the country. Automobile travel emanating from within Florida as well as travel along the I-95 and I-75 corridors from major population centers throughout the Northeast, Midwest, and Southeast have carried the state during its most difficult period ever.

As the first quarter wears on, we expect that families across the eastern seaboard suffering from cabin fever will again take to the highways, primarily funneling to the warmer, more open environs of Florida. Most beachfront properties have tweaked their operational expense models to be profitable in the COVID-19 landscape, to the point where many are able to cover debt service. For investors underwriting most hotels around the country, current cash flow deficits are extrapolated forward and deducted from valuations on a dollar-for-dollar basis. For many Florida beachfront properties, however, this is less of a concern.

Recovery in Focus

The biggest question for most hotels in America is: “When does corporate and group demand return?” With “work-from-home” taking hold and conventions grounded, leisure transient travel has been the primary saving grace for the domestic hotel sector. The prevailing industry sentiment for a return to normalcy in corporate and group demand is predicated on a successful COVID-19 vaccine distribution program, followed by a yearslong ramp up in travel as employees return to the office and employers send their teams on the road. It is evident that the pandemic has negatively impacted the hotel industry, at least for now. What is also apparent, however, is that the slice of the hospitality pie occupied by Florida has grown.

Fortunately for Florida beachfront hotels and resorts, the vast majority of business during normal periods is leisure-oriented. Corporate transient travelers have never been a material component to Florida’s beachfront demand, and leisure demand has remained consistent during the pandemic. We expect it will increase even more dramatically as the vaccine rollout continues. Families that have foregone vacations to protect their elderly relatives and friends will take to the road, many with pockets lined with financial savings. Moreover, the group business that beachfront hotels typically have on their books skews toward social groups. A sizable backlog in weddings and other family celebrations has created a robust pipeline of group events tailored to the leisure experiences Florida’s beaches offer.

While the recovery timeline for the broader hotel industry is cloudy at best, if the vaccines prove successful in substantially taming COVID-19, it is easy to visualize a strong second half of 2021 for Florida beachfront hotels and an objectively stellar peak season in the late winter and spring of 2022. Average Daily Rate along the beaches has remained incredibly resilient over the last year even as occupancies have dipped, making a swift return to pre-pandemic RevPAR simpler to underwrite.

Recovering Debt Markets

After vanishing entirely in early summer 2020, the hotel lending community has warily reemerged. Most lender efforts have focused on keeping existing loan books afloat through restructurings and forbearance. CMBS originations remain practically dormant, and few lenders have ventured meaningfully into making new hotel loans, although some have been successful in putting money out. For traditional lodging lenders, including banks and insurance companies, risk tolerance has been adjusted, and many tap out at loan-to-value ratios 15%-20% lower than pre-pandemic, requiring purchasers to bring more cash to the table. Debt funds and alternative lenders who have emerged to fill the gap in the capital stack have been pricing their debt capital at materially higher interest rates, making it challenging for a borrower to accept prevailing terms, especially in today’s tenuous operating environment.

Fortunately for beach assets, many lender concerns are mitigated by strong leisure demand and the fact that resort-location hotels have outperformed during the pandemic. As financing returns to the marketplace, beachfront assets should be even more attractive to the lending community.

Moreover, many would-be acquirers are so intently focused on purchasing quality assets at the moment that they are likely willing to finance a long-term investment of a beachfront property with 100% equity, and then bring a lender into the equation later, once the debt markets further heal.

Optimistic Valuations

Over the course of the past decade, Florida has emerged as a high-growth state, fueled by population relocations, no state income tax, and business-friendly governments. The 2017 tax code changes accelerated the state’s growth, as the cost differential between Florida and many of the major metros in the Northeast became even more stark. The COVID-19 pandemic has only turbocharged the trends. Tech companies are finding their way to Central and South Florida, and more finance firms are relocating their headquarters to the state. Affluent professionals have embraced the work-from-home lifestyle and have opted to plant permanent roots in Florida, moving from more expensive and congested metropolises. The institutional real estate investment community has noticed, making investments in Florida office, multifamily and hospitality assets.

As travel ramps up again, Florida will be among the first states to benefit from even more leisure visits. As corporate travel recovers, a larger percentage of the country’s workforce lives in Florida. As group demand returns, Florida’s inviting hospitality will be on every meeting planner’s radar. The state will further benefit from the permanent closures of many group-oriented hotels in larger gateway markets around the U.S., effectively compressing group demand southward.

Within Florida, beachfront hotels and resorts stand head and shoulders above their peers in their allure. Their resilience amid the current crisis, the invitation to freely get out into nature and relax, and the lack of direct new supply creates a niche unlike any elsewhere in the country (after all, there’s no way to make more beach!).

Florida beachfront assets are some of the most attractive destinations in the country today. The Plasencia Group’s phones ring daily with investors looking to get in on a piece of the action in Florida before it’s too late. The marketplace is awash with more unplaced equity today than at any point in history. Quality inventory available for purchase is at all-time lows. To owners of Florida’s beachfront hotels and resorts wondering how long you’ll have to wait to exit at a pre-pandemic valuation, the answer is: we’re already there!