Spring 2019 Lodging Investment Roadmap

Posted April 3, 2019

Only last summer, in our Lodging Investment Roadmap, we suggested “no major causes for concern with the broader economy within the next 18 to 24 months,” at least through the summer of 2020. We still believe that the balance of 2019 will pretty much mirror 2018, with positive, yet more subdued growth in hotel operating fundamentals. We do expect an increase in transaction activity, especially during the second half of this year. However, we are beginning to see indications of impending headwinds. The term “late cycle” that we’ve been hearing on the periphery for so many months may finally be coming to fruition.

In this issue, we’ve summarized information and opinions that we hope will be helpful to you when considering strategy for your hotel and resort portfolio.

WILL LATE CYCLE CONCERNS IMPEDE HOTEL INDUSTRY GROWTH?

Coming off a record-breaking year in 2018, the United States hotel industry appears poised for another year of positive performance through 2019. A decade into the longest running bull market in history that has helped fuel the hotel industry’s growth, investors remain cautiously optimistic as they eye a possible economic downturn. However, a healthy economy, low interest rates, record low unemployment, and tax reform legislation that went into effect last year, are breathing further life into expectations that the economic cycle will continue for a bit longer.

Industry experts forecast a rise of 2.3% in both Average Daily Rate (ADR) and Revenue per Available Room (RevPAR) and little to no growth in occupancy this year. Again, while those predictions represent slightly slower growth in hotel performance, we still expect to see an increase in transaction volume in 2019.

That increase will be driven by the sentiment that we are closer to the end of the economic cycle than to its start, and by the volume of capital now flowing into the marketplace. We have witnessed hotel owners buying, fixing and holding their properties for an unusually long period in this cycle, rather than buying, fixing and selling. Investors are now seeing an opportunity to harvest profits in anticipation of the end of this strong economic cycle.

As a result of more investment opportunities becoming available, we anticipate the next twelve to eighteen months will be very active for transactions. Investors such as private equity groups, high-net-worth individuals, and family offices will seek to avoid the mistakes of the last cycle after holding too long into the last recession, having to retain assets through the down-cycle, or worse, losing properties to banks and servicers. Based on those experiences, investors may be willing to leave some money on the table today and sell while they can still make a meaningful profit.

Given the growing number of investors looking to exit and the increasing amount of debt and equity capital seeking hotels, we also anticipate average price-per-key metrics to increase in 2019, ahead of last year. According to HVS, a greater number of sales of larger, higher-priced hotels drove up the average price per key for all transactions by 21% in 2018, to $153,000, compared to $127,000 in 2017. In fact, in 2018, five hotels were acquired for more than $1 million per room, and two hotels – the Soho House Chicago and the Plaza Hotel in New York – sold at more than $2 million per room.

WHAT TYPE OF INVESTORS ARE AT THE FOREFRONT OF LODGING TRANSACTIONS TODAY?

Domestic and international investors alike seem to be more enthused than ever about acquiring hospitality assets. Hotels have come into their own as a separate and alluring investment class because they offer owners the ability to raise rates at a pace higher than other real estate types when the economy is performing well. High-net-worth individuals and family offices are finding hotels to be attractive investments as they seek consistent yield from what they consider to be alluring and fun-to-own real estate.

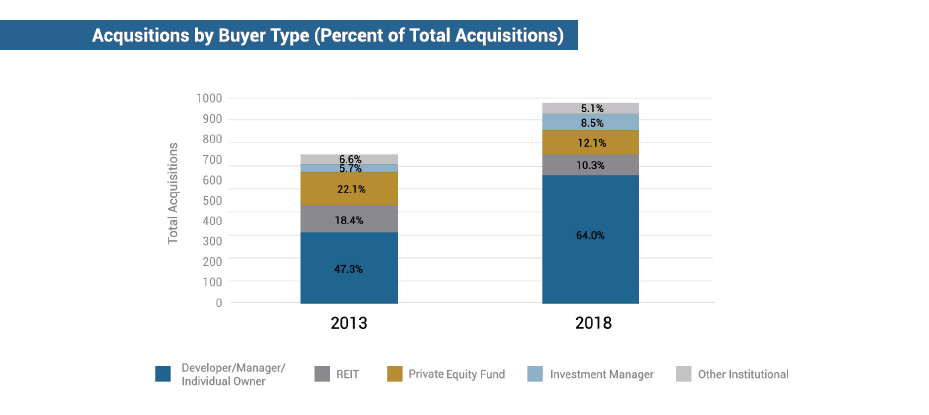

These individual high-net-worth owners, along with developers and hotel management companies, have taken a larger share of hotel deal volume over the last six years, on both the buy and sell sides. Between 2013 and 2018, the combined share of hotel acquisitions from these three categories of investors rose to 64% from 47%, with other types of investors, such as Real Estate Investment Trusts (REITs) and Private Equity (PE) funds, actually seeing their portions shrink. The same is true on the sell side, with those individual owners growing to 44% from 41% over the same period.

Interestingly, while REITs and PE funds may be buying fewer hotels and resorts, their acquisitions today consist of more premium and higher-priced assets that elevate the overall quality of their portfolios. We expect REITs and PE funds to continue to be judicious in their acquisitions, at least until recessionary trends manifest themselves, and “buy” opportunities begin to become more unmistakable.

Hotel capitalization rates have remained steady in the luxury and full-service segments during the past year and while rising slightly in the select-service and limited-service categories. Last fall, the average cap rate for limited service hotels stood at 8.5%, with select-service at 7.8% followed by full-service hotels at 7.1% and the luxury segment at 6.2%. We expect to see much of the same for 2019.

Hotels have also been generating strong internal rates of return for investors as compared to most other real estate asset classes. By the end of 2018, lower-tier hotels were offering an equity yield of 20.2%, mid-scale hotels at 18.8% and upper-upscale and luxury properties at 16.8%, according to HVS.

HOW IS SUPPLY SHAPING UP IN DIFFERENT HOTEL SEGMENTS?

Several markets are experiencing massive increases in supply, especially Southern California, Denver, Houston, Dallas, Nashville, Tampa and Southeast Florida. Atlanta and New York City have also seen significant spikes. Markets like these, that can absorb new supply fairly readily, typically exhibit certain characteristics, including a strong convention business, a solid base of leisure clientele, or both.

Nashville, Tennessee is a good example of a city that has fared well, notwithstanding major increases to rooms supply. With the Gaylord Opryland Resort & Convention Center, Nashville is a city that enjoys both great convention business and ample leisure amenities. At least 20 new hotels are expected to open in the Music City this year, according to STR. Even with roughly 3,500 new rooms (7.8% of existing supply) under construction, the market is still experiencing strong transaction activity and pricing. Another city with strong performance dynamics despite more hotel rooms is Orlando. This southern city continues to see strong numbers thanks to its many theme parks and record- breaking convention activity.

Hotel construction in the U.S. has been moving at a torrid pace for the past three years in a number of key cities. Approximately 45% of the rooms under construction today are being built in STR’s Top 25 markets alone, with the rest being built across the remainder of the U.S. In just the past year, the industry experienced a 6.6% increase in rooms under construction. Market share for those new rooms is dominated by two hotel giants, Hilton and Marriott, capturing a combined 60% of the new supply between them. Industry-wide, more than 70% of new properties being constructed are in the upscale, upper-midscale, midscale and economy segments.

There will be few large full-service hotels built over the next two years. There will be even less new supply in the luxury category given the significant cost to build this class of product. As a result of low supply and high demand, STR and Tourism Economics anticipate the luxury segment will experience some of the highest RevPAR numbers in the hotel industry in the next few years.

Overall, demand for hotel rooms across the U.S. remains healthy, but markets with supply increases are experiencing the lowest rates of growth in occupancy and ADR. STR and Tourism Economics forecast some slowing of demand across the U.S. from 1.9% in 2019 to 1.7% in 2020. Fortunately, over the same period, supply growth is expected to remain flat, at 1.9%, for each of the two years.

WHAT IS THE IMPACT OF SOFT BRANDS AND INDEPENDENTS?

Today there are so many soft brands affiliated with more established hotel brands that is often difficult for guests to discern nuances and differences. The parent brands such as Hilton, Hyatt and Marriott use soft brands to appeal to specific customer segments, whether they are millennials and business travelers focused on technology or individuals seeking wellness experiences.

Hilton currently offers 15 brands, including Canopy and Curio as its soft brands. It introduced the Motto flag last October. Hyatt’s soft brand is the Unbound Collection, a portfolio of upper- upscale properties. Among Marriott’s 30 overall brands, soft ones include the Luxury Collection, Autograph Collection and the Tribute Portfolio.

These soft brands provide owners with the benefit of the larger hotel company’s reservations and national sales systems, often without the pressure to adhere to stringent design specifications and remodeling schedules normally required by the parent company for their other flags. Operating and design standards are typically far more flexible for a soft brand than for a full-service hotel.

Independent hotels not affiliated with any flag clearly may find themselves at a disadvantage. The marketing resources that major brands such as Hilton and Marriott offer far outweigh the costs of affiliation. While some owners may disagree, our view is that, for the most part, hotels affiliated with a major brand’s reservation and sales system perform significantly better, especially coming out of a recession.

HOW DO LENDERS VIEW NEW CONSTRUCTION?

Financing for new construction and development is shrinking. Lenders have become more cautious as we approach the top of the cycle and asset values are hitting their peaks. This is a dead giveaway that the good times may be over for the building frenzy, at least in the lodging sector. The result will be less new supply entering the market over the next 12 to 36 months. While construction will remain busy, it will not continue at the pace experienced in the past three or four years.

Lenders learned their lesson in 2008 and 2009 when the Great Recession hit and they have become more disciplined over the last decade. Even over the past year, borrowing terms for new- build properties have tightened. Consequently, it has become more difficult to obtain financing for new construction now. Even so, there are several variables in a new project that lenders often seek before committing funds. They appreciate the affiliation with a major hotel brand and consider how demand in a particular market will support the contemplated supply. They also scrutinize the quality of the sponsorship and the financial wherewithal of the borrower seeking to ensure that their debt can be adequately serviced in both good times and bad.

That last point demonstrates the biggest concern lenders have: the possibility that the U.S. economy could falter in the next 12 to 24 months. Lenders are also apprehensive about rising construction costs for new properties driven by higher-priced materials and technology, and a shortage of skilled construction workers. Notably, we have not seen any major tightening of credit terms in the last year for acquisitions of existing properties.

WHICH HOTEL INVESTMENT MARKETS ARE ON THE RISE?

Quality hospitality investment opportunities in major markets have been more difficult to come by in recent years. Manhattan, Southern California, Northern California, Chicago, Boston, and South Florida have all seen a decrease in hotel transactions since peaking around 2011 and 2012, according to Real Capital Analytics (RCA).

High prices in first-tier cities are forcing many investors to consider other cities in search of better value, a trend that is likely to continue through 2020. These secondary or tertiary venues have now become increasingly attractive to investors who found themselves priced out of the traditional primary locations. As is often the case late in economic cycles, investment capital typically bypasses overvalued first tier markets and instead enters less expensive and equally attractive second tier cities. Eventually, capitalization rates in first- and second-tier markets converge. Premium cap rates on secondary market hotels can range from 75 basis points to 100 basis points higher than major cities, and a full 300 basis point higher than top tier markets. We anticipate that we will see declining cap rates and higher sale prices for assets in secondary cities.

Our firm has found that a new wave of non-gateway markets has come to the fore. Cities such as Atlanta, Charlotte, Dallas, Indianapolis, Jacksonville, Kansas City, Orlando, Phoenix, Salt Lake City, and Tampa have seen noticeable spikes in the number of transactions taking place there in recent years, according to data from RCA. Markets that some may label as “tertiary,” such as Gainesville, Florida or Amarillo, Texas, have also seen sizeable deal activity. These secondary or tertiary markets are generally characterized by high population growth, lower unemployment rates, and attractive real estate values.

Based on discussions with investors, the following markets, formerly viewed as secondary, appear to be especially attractive:

- Charlotte: Interest in this city is fueled by a heavy concentration of banking and financial services, a massive regional hub airport, professional sports teams, and a major convention center. Watermark Capital Partners and Summit Hotel Properties recently made significant purchases in Charlotte’s uptown ar

- Salt Lake City: As one of just a few major markets in the American West, Salt Lake City has become an attractive investment alternative to Denver, which is increasingly It has an up and coming economy with a focus on technology and is close to national parks and world-renowned ski venues.

- Tampa: Institutional capital has flooded the local multifamily, office, retail, and lodging Much of this has to do with the multibillion-dollar expansion of Tampa International Airport, as well as its signature downtown waterfront project, dubbed “Water Street Tampa,” being developed by Strategic Property Partners, a partnership of Bill and Melinda Gates’ Cascade Investments and Jeff Vinik, the owner of the NHL’s Tampa Bay Lightning.

- Houston: While Houston was hard-hit by the decline of the energy sector, investors have found the market to be very resilient and well-div A great number of contrarian capital sources are getting back into the market, especially in the Downtown, Galleria and Medical Center submarkets. Houston has also excelled of late in the convention arena with a greater concentration of larger and newer hotels available for the first time in decades to meeting planners.

- College Towns: The combination of distinctive cultures, consistent and diverse demand, young and innovative workforces, and demographic growth makes them ideal target markets for many investor

Transaction compression is evident on a more micro level, as nearby suburban areas and submarkets often feature, but at much lower prices. The most obvious example is the New York metropolitan area. While Manhattan has seen a drop in transactions recently, surrounding submarkets including the city’s other boroughs, its suburbs in Long Island, Westchester, and the New Jersey suburbs have seen increases. This is evident in Florida as well, where there has been a shift from Miami-Dade, Broward, and Palm Beach Counties to other Florida markets including Tampa, Orlando, Jacksonville, and Southwest Florida.

Finally, we’ve also found that investors are interested in a broader range of lodging establishments. Resorts and hotels in destination markets are increasingly popular among prospective investors, as are limited-service hotels. Groups that formerly might have focused only on full-service hotels in top ten markets might now consider limited-service assets in destinations such as Boise, Idaho; Moab, Utah; Bloomington, Indiana, or the Carolina coast. As investors become more creative and adventurous in their prospecting, the new generation of attractive investment options will continue to expand.

On the Road is a collection of some of our favorite places we have visited as we travel the country. Our recommendations, and those of friends of the firm, may be found at tpghotels.com/on-the-road.

On the Road: Salt Kitchen & Bar

588 Wentworth Road, New Castle, New Hampshire 03854 | wentworth.com/new-castle-salt-kitchen-bar | (603) 422-7322

A trip to Portsmouth isn’t complete without a meal at Salt Kitchen & Bar, located in the historic Wentworth by the Sea Marriott Hotel & Spa.

What to Order: The flatbread pizza is absolutely the best I have had anywhere in the world. The dough is made with very little, if any, sugar, creating a thin and crisp crust when cooked in a high temperature oven. The ingredients include fresh tomatoes, mozzarella pulled on-site, fresh herbs from the restaurant garden and most any other topping you would like. This shareable meal makes for a truly memorable dining experience, particularly when paired with a Sangiovese or Gamay-based red wine.

Suggested by: C.A. Anderson | (813) 445-8281 | ca.anderson@tpghotels.com

Seeking your recommendations! As On the Road grows in popularity, we welcome your suggestions for must-stop spots from our clients and industry friends. Submit your favorite places by visiting tpghotels.com/on-the-road.

Introducing Guy Lindsey

In September 2018 Guy Lindsey joined The Plasencia Group as Senior Managing Director of the firm’s Development Management Consulting (DMC) division. DMC provides advisory and consulting services related to ground-up development and renovations, project construction and management, and financial reporting for hotel and resort owners and developers across North America.

Guy joined the team with extensive experience in the hospitality sector. Prior to joining The Plasencia Group, he served as Senior Vice President of Design & Construction with Park Hotels & Resorts. Preceding his tenure at Park, Guy held senior development roles at Sunstone Hotel Investors, Northview Hotel Group, and Holiday Inn Worldwide, among other successful companies. Throughout his career he has worked on myriad hospitality projects, including iconic properties such as the Boston Park Plaza, Hyatt Regency San Francisco, Wailea Beach Resort, Hawks Cay Resort, and the Hilton San Diego Bayfront.

Guy Lindsey

Senior Managing Director –

Development Management Consulting

Under Guy’s direction, DMC provides sound guidance on some of our clients’ most prized assets. Please don’t hesitate to contact him to discuss upcoming renovations and developments for hotels and resorts in your portfolio. He can be reached at (813) 445-8324 or glindsey@tpghotels.com.

Lodging Investment Roadmap Summary

Investor appetite for quality hotels and resorts is voracious, especially in certain, well-performing first and second tier markets. Meanwhile, successful hotel and resort proprietors, many of whom have now held their assets far longer than intended through this historic upcycle, are now calling on us to help them cash in on the success of their portfolios. The timing may be ideal for you to consider a sale, a refinancing or a repositioning of your hotel and resort holdings. We would be honored to advise longtime and new clients alike on what we believe to be the best course of action for your portfolio and would welcome the opportunity to reconnect with you. Until then, all the best!