Summer 2018 Lodging Investment Roadmap

Posted September 6, 2018

Four full economic cycles and 25 years have given The Plasencia Group’s most tenured principals valuable experience that can only be gained during market highs and lows. Even with that firsthand knowledge, we continue to witness market and investment conditions in the current cycle that are quite different from virtually any previous period. We’ve said it in prior Lodging Investment Roadmaps: there is nothing constant except change, especially in the ever-evolving arena of hotel and resort investments. In this issue, we’ve rounded up information and opinions that we believe will equip you and your colleagues with knowledge to help inform business decisions related to your hospitality holdings.

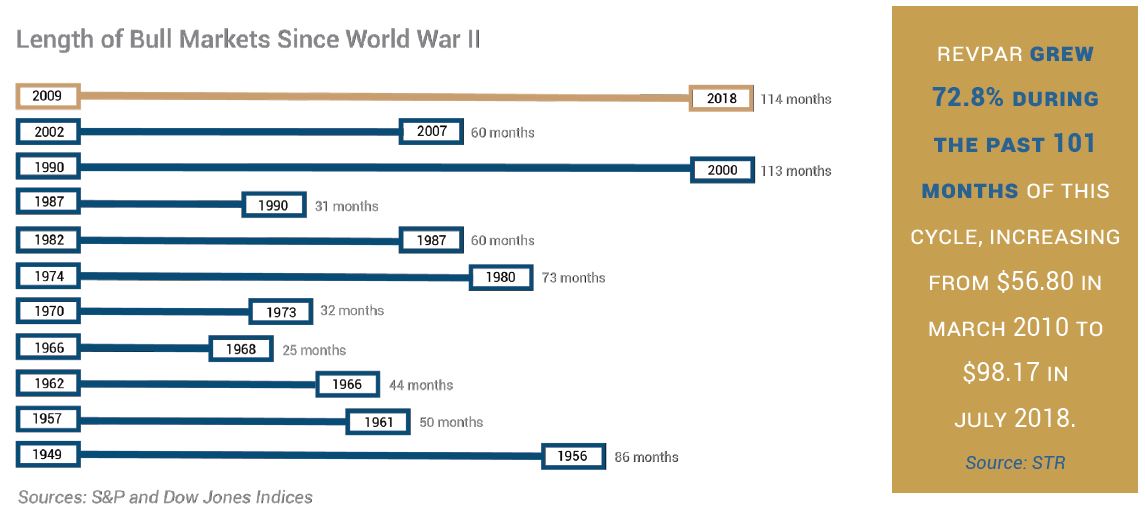

IS THERE AN END IN SIGHT FOR THIS BULL MARKET?

Wall Street is now in the midst of the longest bull market since World War II, lasting 114 months, and counting. This economic upcycle, which began in 2009, has also greatly buoyed the lodging sector, which is itself in its 101st month of positive RevPAR growth. The month-after-month reports of strong economic and RevPAR news is certainly positive, and consistent growth is undeniably a good thing. However, the sheer length of this upcycle causes some to wonder if the end is nearing for this bull market.

We believe that there are no major causes for concern for the broader economy within the next 18 to 24 months. The concerns that do exist, including those over political uncertainty, international relations, and the potential for a Black Swan event, are greatly outweighed by steady, if not robust, economic indicators. The nation’s economy continues to do well notwithstanding a more uncertain political environment in the U.S. and abroad. Despite this seemingly unsettled global environment, U.S. volatility indices are relatively low. Concerns over inflation growth have moderated, corporate earnings are strong, household spending has increased, and unemployment hovers around 4%. All told, we feel there is cause for rational exuberance on a macro level, although we also we believe we are certainly closer to the end of this cycle than its beginning.

WHAT WILL BE THE IMPACT BE OF RECENT TAX LAW CHANGES AND GOVERNMENT SPENDING?

In our last issue we examined the positive effects associated with the Tax Cuts and Jobs Act and the Bipartisan Budget Act, signed into law on February 9, 2018. While the benefits of the legislation were immediate and continue to be felt seven months later, we believe it is important to look ahead at the longer-term impact of the tax law. The effects of the tax cuts were purposely geared toward maximizing front-loaded returns to the public. The current velocity of the U.S. economy is clear evidence that new tax law is working as expected. Second-quarter GDP jumped 4.1% for best pace in nearly four years. The nation’s unemployment rate has been hovering around 4% since last October and is now at a 17-year low. Meanwhile, the lodging industry’s profit margins are virtually at all-time highs. However, many economists are now looking ahead, particularly at 2020, when the Budget Act’s caps on government spending begin to kick in.

In our view, once the Federal government stimulus begins to slow, 18 months from its inception, as the law requires, it will most likely begin to create a drag on U.S. economic activity starting next summer. Two other factors could lead to deleterious effects. The first is the Federal Reserve Bank’s stated goal of a 25-basis point quarterly increases in interest rates. Due to inflation and economic pressures, the Fed will be highly motivated to more aggressively tighten policy if the economy continues its overheated pace. As rates rise, the yield curve will flatten.

The second issue that could create friction for the economy is the upcoming U.S. mid-term elections. Tax reform may have given a boost to Republicans, but it is unlikely to save the party. Should Democrats take control of the House of Representatives this November, economic growth could potentially hit the brakes, or worse. A Democrat-controlled House could expand spending caps further. Given the Fed’s planned rate increases, a few economists, especially those who are incredulous that this upcycle has lasted so long, are once again mentioning the “r” word (yes, recession!). The message to hotel owners and operators is clear: take full advantage now of the current economic boon. Taking money off the table while things are still good may be a prudent move. It will be much more difficult to raise ADRs and exit or finance assets should the economy slow to a crawl. Even if the decline is gradual, things have been so good for so long that any signs of a decline may cause the “sky is falling” crowd to begin running for the hills.

WHAT IS THE CURRENT SUPPLY-DEMAND DYNAMIC IN THE LODGING INDUSTRY?

Much has been made of the increase in new hotel room supply over the past few years. There is no question that construction has factored into the relatively modest RevPAR growth we’ve seen in recent months in most cities across the country. However, demand continues to outpace supply nationwide, albeit by a relatively small margin. This dynamic obviously varies on a market-by-market basis, but nationally, as supply growth peaks and ultimately starts to dissipate experts expect this will occur in 2019), demand growth should remain steady. This should create an even healthier supply-demand relationship in the lodging space going forward.

The national supply increase is heavily swayed by an abundance of new hotel projects in major markets. New York, Orlando, Dallas, Nashville, Denver, Seattle, and Philadelphia all have more than 5% of their current room supply under construction. It is no surprise then that many of these markets are achieving RevPAR growth below the national average. Smaller markets and those cities that have already absorbed new supply are likely to be the most stable, from a RevPAR growth standpoint, over the next couple years.

Nationally, the one concerning trend we see on the demand front is that Group business and associated banquet revenues are maxing out. We believe there is a great opportunity for hotels and resorts to grow Transient, specifically from the Leisure segment. If hotels focus on attracting a greater share of higher-rated Leisure Transient guests, they can more aptly counteract the decline in Group and banquet business.

Demand for rooms began to once again overtake the increase in new supply in early 2017. Through mid-year 2018, STR shows demand continues to outpace supply, with a 3.0% rate of growth. The number of new rooms that opened in the first half of the year, on the other hand, has begun to taper. STR shows new supply grew by 2.0% in that period.

WHY IS SUPPLY GROWTH EXPECTED TO SLOW?

Supply growth should slow in the coming months and years for a variety of reasons. The cost of labor and construction materials are a constant challenge to hotel development. Investors can find already-operating hotels available on the market at prices well below replacement cost. Similarly, financing for construction is much more difficult to obtain than it is for an operating hotel with cash flow. Yet another issue is the availability of relevant and meaningful brands. Almost all major markets, and many secondary and tertiary markets, feature major brands across all chain scales, leaving relatively unknown or nascent brands as the only options for ground-up developments. Taking a chance on building a hotel with a new, unproven brand is not a risk many developers are willing to take.

WHAT ARE PREVAILING THEMES IN RECENT HOTEL TRANSACTIONS?

New, premium-branded select assets are at the top of most buyers’ wish lists. Resorts, especially waterfront properties, are also in high demand. The most desirable markets for investors include Top 25 markets where supply isn’t a major threat, as well as more secondary, up-and-coming venues such as Southwest Florida, Charleston, Salt Lake City, and similar markets. Some investors are looking at contrarian plays in major markets that have built-in value but have recently struggled in terms of RevPAR. These include Houston, New York, and Chicago, although other metro areas such as Denver, Dallas, and Seattle may also see supply challenges ahead.

Brands continue to provide significant challenges to getting transactions across the finish line. Many chains have imposed exorbitant levies to both seller and buyer as hotels change ownership. Brands are also getting tougher on older generations of properties, often mandating certain aging hotels be either down-branded or de-branded completely.

HOW DOES THE CHANGING PROFILE OF BUYERS AFFECT PRICING?

Arguably the most notable new development we have seen in our recent transactions is the assertive posture buyers are taking to distinguish themselves. There is an abundance of capital today looking for deals, so buyers are seeking to stand out to be selected by sellers. Techniques to stand apart include making pre-emptive offers at or above guidance, significant moves in pricing between the first and second round of offers, very short diligence periods and, in extreme cases, hard deposits at signing of letter of intent. Investors seeking to place funds are more aggressively pursuing off-market deals and directly approaching owners more often than in the past. Also driving more aggressive pricing is an influx of a new cadre of investors. High-net-worth individuals and family offices that may not have previously invested in hotels are now seeking the strong cash-on-cash returns that lodging investments provide. These groups may have a history of investing in other real estate asset classes, but are now enticed by the transparency in operations that hotels offer, and the higher cap rates that hotels trade for, relative to other asset types.

While private equity firms and institutional investors have vast sums of capital to place, their investor return hurdles are much higher than these private, longer term buyers, giving this growing investor class an edge in pricing. Due in large part to this buyer aggressiveness and free flowing capital, cap rates in the hotel space remain relatively flat, despite rising interest rates.

IS FOREIGN CAPITAL STILL PLAYING A MAJOR ROLE ON THE HOTEL INVESTMENT SCENE?

While foreign investment in U.S. lodging is down compared to past years as Chinese money retreats, offshore capital still makes up a major piece of the buyer universe. These foreign investors, be they Latin American, Middle Eastern, or European, primarily invest in hotels indirectly, mainly through established domestic entities. These U.S.-based partners (fund managers, brands, asset managers, etc.) source deals and guide the foreign capital through the investment process. Over the past couple years, these international investors seemed focused on making large purchases mainly in gateway markets; however, we are now seeing them move into secondary markets, acquiring smaller hotels that offer stronger returns, often as part of a portfolio.

On the Road: The Olde Pink House

23 Abercorn Street, Savannah, Georgia 31401 | plantersinnsavannah.com | (912) 232-4286

The Olde Pink House is a Savannah institution and a must-visit spot if you’re in the area. The restaurant building itself is, as the name suggests, an old pink house that was originally built in the 1700s right off of Reynolds Square in the center of what is now the historic district. It has several dining rooms, grandiose chandeliers, and period artwork and decor, making it a cool, beautiful place to enjoy a good Southern meal. Dining in their downstairs “vault” wine cellar is a unique experience. The restaurant’s charm and delicious Southern food make it popular among tourists, but it is not a tourist trap by any means.

What to Order: Go for the BLT Salad, although calling it a “salad” may be a bit of a stretch. It is presented almost like a napoleon, with layers of fried green tomatoes, thick cut bacon, and lettuce, all drizzled with a ranch dressing. Everything is prepared to perfection: crispy and tangy fried green tomatoes, tender thick cut bacon, fresh greens, and creamy and peppery dressing. The fried chicken also ranks up there as some of the best in the South.

Suggested by: John Plasencia | (813) 445-8263 | jplasencia@tpghotels.com

On the Road is a collection of some of our favorite places we have visited as we travel the country. Our recommendations, and those of friends of the firm, may be found at tpghotels.com/on-the-road.

Introducing C.A. Anderson

The Plasencia Group is pleased to announce that C.A. Anderson has joined the investment advisory team as Senior Managing Director of the firm’s Mid-Atlantic region. Mr. Anderson is based in the Washington, D.C. metro, near the headquarters and satellite offices of some of The Plasencia Group’s most active lodging industry clients and partners. He is responsible for investment advisory services, working alongside the rest of the firm’s team, to aid lodging investors with their transaction and strategic consulting needs.

Mr. Anderson joins the team with an impressive 30-plus year track record in the hospitality sector. Prior to joining The Plasencia Group, he served as Senior Vice President of Global Development & Real Estate with BridgeStreet Hospitality. Preceding his tenure at BridgeStreet, Mr. Anderson was Managing Director of Cambria Investments with Choice Hotels International. He has also held senior executive positions with Interstate Hotels & Resorts, Barings, Red Lion Hotels, and Japan Airlines, among others.

C.A. Anderson

Senior Managing Director

Please join us in welcoming C.A. to the team! He may be reached at (860) 573-7744 or ca.anderson@tpghotels.com.

Lodging Investment Roadmap Summary

We’re moving toward the last quarter of 2018 at what seems like a blinding pace. Invariably, the clients who have called on us of late are evaluating the most prudent moves they can make in today’s environment, whether it be a sale, acquisition, refinancing or repositioning. Please don’t hesitate to contact us as you execute the remainder of your 2018 plan and look ahead to your lodging investment strategy for the future.